2024: The Recession Year?

Why the odds are high and what it means for markets

In my last two posts “Always Reflexivity” and “Be fearful when others are greedy” I first described how most observers call for a soft landing of the US economy in ‘24, which would likely mean either a re-acceleration or a recession, as economists’ consensus barely ever happens (cf. “On Reflexivity” for the reasons why). I then laid out how both very bullish market sentiment as well as a collapse in the latest inflation data lead me to see the downside risks for ‘24 as more likely, with a recession as probable outcome, and how I positioned accordingly

Today’s post expands on the reasoning for said case, what speaks against it and as always I summarise what it would mean for markets

To start, let’s refresh the classic inflation cycle playbook as it occurred countless times across the developed and developing world over the past 150 years. It goes as follows:

The government prints new money and hands it to consumers

Consumers spend this additional money. Since it is printed, the productive capacity of the economy has not increased. Companies raise prices as demand exceeds what they can provide. Inflation ensues while their profit margins shoot up. This is the “boom phase”

In absence of further new money, consumers are now stretched and their spending stalls at the new high nominal level. At this stage the common complaint is that “everything has gotten so expensive”. Stalled spending means corporate revenue growth slows. This is the “overstretched phase”

Corporate costs continue to increase. Especially labor costs keep growing with longer-term agreements, and as consumers demand high wages to deal with higher living expenses

Further, while nominal corporate sales have increased, volume are flat or even down. So companies often have too much staff. Faced with higher costs and slower sales, they cut employment. This is the “bust phase”

At this stage, the economy needs fresh money. The Central Bank can try to provide it by cutting rates and thereby encouraging consumers and corporates to take on more credit. Should that fail, then governments often turn on the printing press again, which then leads to a second inflation wave, and so forth

In summary, the consequences of printing money are usually unpleasant and painful to get rid of. This is why governments don’t print money all the time, if it had no serious side effects, we would always do it

Now, the US printed trillions of US Dollars during Covid. A soft landing would mean it could escape said sequence. I think the data is now increasingly showing that this is not the case

Let’s walk through it step by step

The US consumer is increasingly stretched

Delinquencies on credit card loans are now the highest in 25 years on lower quality cards, and the highest in >10 years on average cards. They continue to trend up

Looking further under the hood, particularly younger age brackets are squeezed. These spend most of their income, as families are formed and wealth has not been established yet etc.

Summary: Rapidly rising credit card delinquencies are a strong indication that US consumers are at the very least struggling to increase their expenditure

If the consumer is stretched, corporate pricing power should decline. We see that now

The first glimpse at the Q4 ‘23 earnings seasons had a common theme, with bellwethers FedEx, Nike and General Mills all reporting difficulty passing on cost amidst disappointing volume

We see this dynamic foreshadowed in the below chart which I already shared last week. It plots the Fed’s favorite inflation measure Core PCE against the NFP wage growth measure, and can be seen as a proxy for corporate revenue vs corporate cost. I found the very rapid drop in Core PCE particularly concerning

Summary: Corporates are losing pricing power while their costs keep increasing. A margin crunch is likely ahead, with cost cuts next

The labor market is close to a tipping point

While regular readers will be familiar with the below chart, discussed in detail in “Will it hold?”, it is important to keep in mind that even ~5% read GDP growth in Q3 ‘23 did not cause a trend turn. Labor demand is softening, but the margin crunch has only just started

US employment trends have steadily softened over the past two years. Should corporate margins get squeezed and layoffs follow, it won’t take much to tip the labor market out of balance

Even with the recent significant yield decline across the curve, bank lending has not picked up at all

Since late October, interest rates across the curve have decline by ~1%, and 150bps cuts are priced in for ‘24. It appears that this is still insufficient to get corporates and households to borrow more. As growth slows and wallets are stretched, they likely see little reason to take on more credit

On the consumer side, this is not surprising as many refinanced their mortgages at rock-bottom rates during Covid-19. Hence, this important channel is removed as a stimulative conduit - 80% of consumer debt is mortgages

Summary: With latest inflation readings running below target already (core PCE 3-months and 6-months annualised <2%), the US economy likely already needs new money. But bank lending is stalling, so more action is likely needed

Sentiment/Reflexivity. The above suggests we may need aggressive government action to stave of economic downside. But like everyone else, governments follow experts and the market, which are both all in on the soft landing

Should rapid disinflation continue in the coming weeks and months, then Fed policy is likely way too tight right now. More so, the unavailability of the mortgage refinancing could suggest that rate cuts alone won’t be sufficient to put more money into consumers pockets

But right now, sentiment is not interested in these considerations, thus reducing their urgency, while they would need considerable time to unfold (ie implementing measures when employment data has cracked is likely too late)

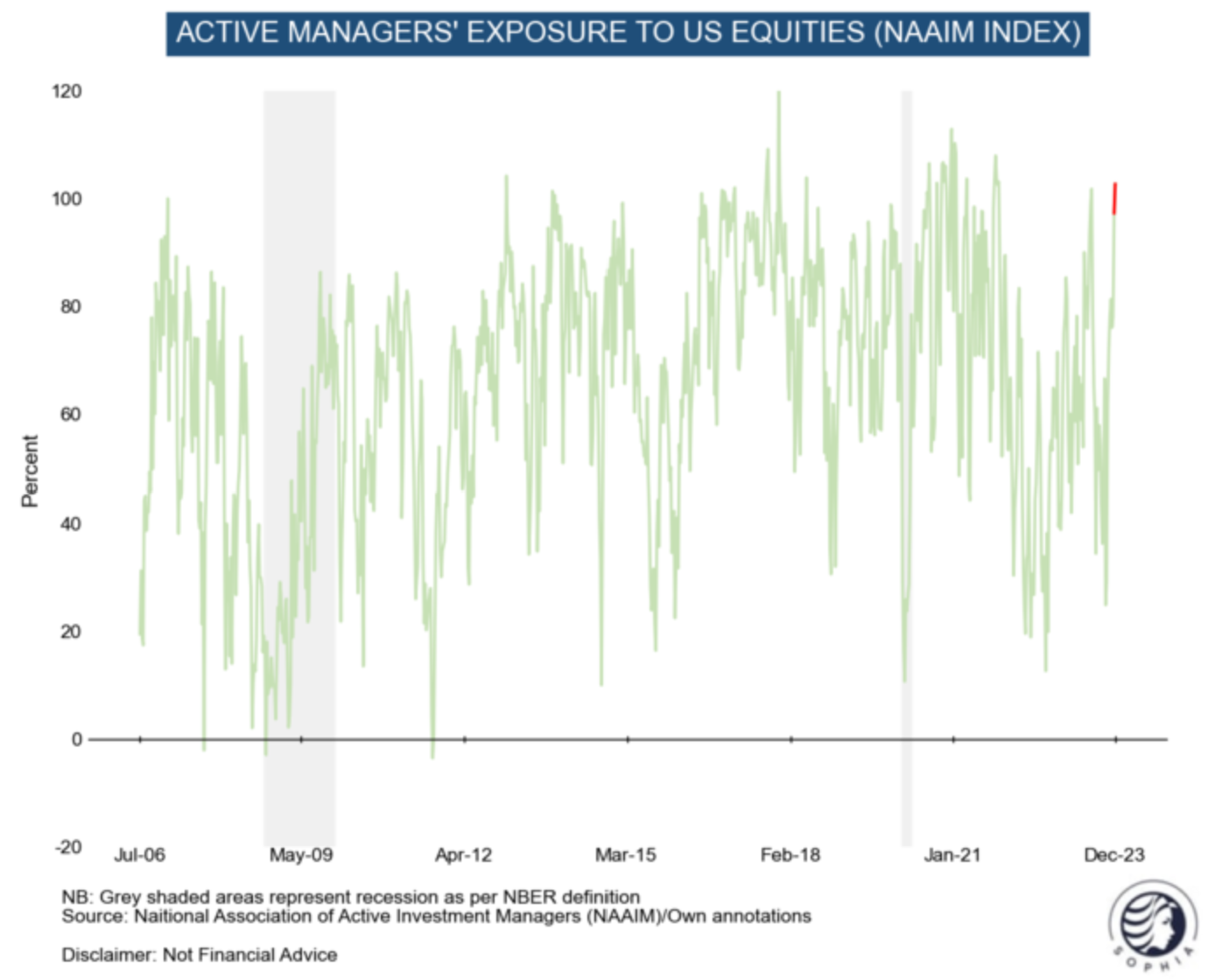

Either way, we see NAAIM manager exposure now in the 98th percentile and CFTC data shows speculators the most long Nasdaq, Dow and Russell 2000 in 2 years

At the same time, Janet Yellen is taking victory laps while she should probably now be more on guard than ever before and hash out plans to fight a rise in unemployment

Summary: In a classic example of Reflexivity, bullish sentiment likely reduces the urgency to act at a time when probably it should go up

As always, this is only one of the many lenses to look at the economic world, and regular readers will know that positioning and sentiment are my most important guideposts, with other analysis flowing from them. With that in mind, these are important pushbacks to my thesis:

The recent loosening of financial conditions is enough to re-accelerate the economy. As discussed before, I had some sympathy with that view, as especially housing is very tight, while the goods economy has destocked. But we have to keep in mind that the implosion of the goods economy over the past 1.5 years was not enough to derail very strong real GDP growth, so the inverse may also apply as consumers are in the driving seat. Further, an end of destocking does not automatically mean restocking takes place

The inflation surge was due to supply bottlenecks which have now unwound. Yes, some of it certainly was. But let’s apply some common sense - the US government (both the Trump and Biden administration) doled out stimulus cheques worth trillions of US Dollars during Covid-19 while there was (surprisingly!) barely any economic scarring. It was funded with debt that was bought by the Fed. Sounds like textbook inflation to me…

If there was supposed to be a recession, why did it not already happen? We were likely already on track last year, but then the ~8% increase in COLA benefits in January ‘23 and the inflation-driven adjustment to tax brackets both boosted consumer income once more, at the expense of a very high ‘23 fiscal deficit. These are unlikely to be repeated in ‘24

We are in fiscal dominance and a panic bid into real assets will take the S&P to 6000. It is possible, but I would think earnings had to expand a lot (rather than contract) for this to happen. Right now, the trend is the opposite, but it may change. A variation of this view is that AI improvements will take the S&P to dramatic highs in ‘24. I find it ominous that these views go around while active manager exposure is max long (see above), but will stay open minded to these possibilities

Conclusion:

The US economy will probably experience a recession this year, as the lingering effects of the Covid-19 inflation wave work thought the system

Rapid disinflation, increasing credit card delinquencies and waning corporate pricing power are likely testaments to these dynamics

More likely needs to be done by the Fed and the government to cushion or avoid its effects. While the Fed probably will end up cutting more than the currently expected 150bps, the government may find it more difficult to act decisively in an election year

Commodity and wage cost inflation may complicate efforts to cut rates, as the goods economy destocked and consumers insist on higher wages

At the same time, a potential recession may be brief and/or shallow as contrary to ‘08 consumers are stretched, but not overlevered

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

As laid out in my last post right before New Year, I pivoted to this more bearish view on the economy and adjusted my book accordingly to these views into year end ‘23:

I took down overall exposure and raised cash

I hedged long commodity stock exposure with US small cap indices. Commodities may benefit from a goods economy that sees some tailwinds from housing and destocking, while the long Russell 2000 trade which I liked in early November has featured in every strategist’s New Year piece, so I think it is very crowded. Both are correlated so hopefully hedged well

I bought a fair amount of S&P puts with Spring maturities. Volatility is at multi-year lows (!) and everyone is long, so it does not take a lot to shake the tree, in which case the return profile for these is very favorable. Keep in mind I may be totally wrong and the market keeps melting up, in which case these would expire worthless. Also, I may sell these at any time

I am still considering the following and may add exposure to these ideas in the coming days/weeks

The US Dollar short seems consensus and oversold. I think it strengthens soon, but keep in mind this trade is highly correlated to equities

Healthcare, Staples and Utilities have all done nothing for two years and all three have just seen near record amounts of insider buying. Maybe these will be the best sectors of ‘24?

Humanoid robotics appears to emerge as a theme that may dominate headlines soon. I do not want to mention single stock exposure in my writing, but would think one can easily find the leaders. I am waiting given my general view on equities, but look to buy here over the coming months

I think there is upside risk to the 150bps cuts priced in right now. I am looking to fade any retracement in the US 2-year

I wish everyone a very Happy and Healthy New Year 2024!

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Happy New year! I tend to agree with your analysis, but expect the recession to develop later in the year.

Happy new year back to you !