Always Reflexivity

Why the slowdown consensus for 2024 suggests economic re-acceleration is the most likely case

Regular readers may have observed one common thread through my work - Reflexivity, or the idea that the economy and financial markets are shaped by countless interdependent feedback loops. As a result, an economic truth ceases to exist the moment it gets priced into markets, as said feedback loops already work to create its next iteration

A perfect example is the outlook provided by sell-side economists for the New Year as the old one draws to a close. As always, it will be highly unlikely that their view, which usually hugs around a certain consensus materialises

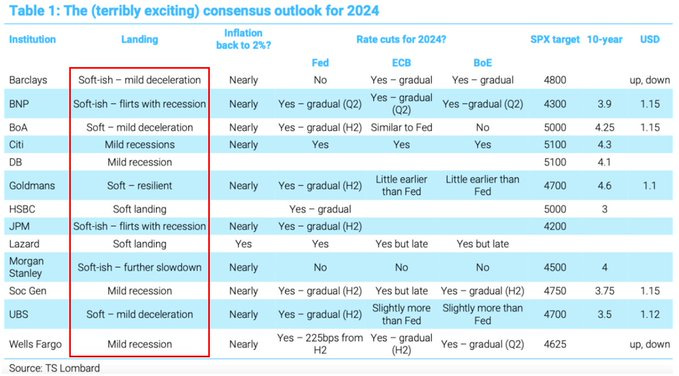

Consensus we can really call it - for ‘24, they all share the same view, as the below table shows - a soft landing with a side order of recession

Applying Reflexivity to this, the outcome will most likely be anything but that. In other words, we will either get an acceleration of the economy, or a hard landing, just not what consensus expects. But why is that?

The reason is simple. The economists’ aggregate view represents what is obvious. Everyone can see what they see, including the Treasury and the Fed

Here’s what’s important - no one wants a recession. If the risk of one is obvious to everyone in the room, action will be taken against it. And that’s exactly what’s happening

It started with the Treasury reducing the coupon amount in its Quarterly Refunding Statement. Last week, the Fed followed and officially pivoted, guiding to rate cuts in the near future

The accommodative vibe is global in nature. This morning, the Bank of Japan surprised markets with a dovish stance, and Governor Ueda mentioned Fed policies several times in his speech

Now, everyone is working against the recession outcome now, but will they be successful? Or will it be too little, too late, and instead we get the hard landing? The odds for successful intervention are decent, in my view, for three reasons:

First, as mentioned in previous posts, the goods economy has concluded a monumental destocking effort, and any steadiness or even increase in demand will bring the global supply chain back to life. We see evidence of this now in real time: US Trucking activity has picked up meaningfully, concluding the worst transport slowdown since the GFC

Second, the US Residential Housing market is a highly volatile GDP component and has lead the vast majority of past recessions. It remains historically tight, with house prices up 4.5% in ‘23 despite 8% mortgages (!). Lower rates are immediately stimulative and housing should contribute rather than drag on ‘24 GDP, as excerpts from the below Redfin article show:

Third, the US is increasingly moving from an income- to an asset-based economy. More Americans than ever own stocks, and higher stock prices are directly correlated to the spending of the top 60% consumers which represent 80% of consumption. Lower rates are THE reason why the stock market is currently on a tear and supportive of recent higher spending

Taken together, the odds are that instead of a soft landing with a side order of recession the US economy re-accelerates in response to fiscal and monetary stimulus. This works until inflation returns, which I deem likely, but with quite some time to pass until then

As always, there is no certainty in any one outcome. Once again, I want to highlight the key risk to this view. I think this is also the risk the Fed is scared of, and why they have pivoted so forcefully. It goes as follows:

As prices have shot up, US consumers have cut back, so nominal growth slows. The Fed’s preferred inflation measure “core PCE” this Friday will likely show an ice cold measure, dropping off rapidly

Rapidly slowing inflation importantly means one thing - rapidly slowing corporate revenue growth. But corporate costs are not slowing at the same pace at all. Especially labor cost increases are sticky and lagging. This is why Small Businesses report their intention to increase prices again, as below chart shows:

But if they cannot raise prices due to weak demand, their margins get crushed and they will have to lay off staff to protect their profitability

The Fed (and the Treasury) are trying to front run this development, rightly so as the risk is real. Importantly, it will require rate cuts soon. Why?

While many large businesses rely on 5-7 year maturities to finance themselves, for which the rates have already come down a lot, many small businesses are much more dependent on the overnight rate, e.g. for inventory or working capital management. They need proper rate cuts, not just the frequently cited “easing of financial conditions”

If your view is that the deviation from consensus won’t be re-acceleration, but a hard landing, then you’re betting that the Fed is doing too little, or that its efforts will be too late to stop this development

With the immediate response to the Fed’s dovish stance from the goods economy, housing and consumption, I think the odds are higher for re-acceleration. But as always, I could be wrong

Conclusion:

Sell-side economist consensus barley ever materialises, as it states the obvious, which means that feedback loops are already in motion to create a different outcome

Applied to ‘24, this makes a re-acceleration or hard landing likelier than the consensus of soft landing with some recession

A very proactive Fed (and Treasury), as well as early signs of a US economy responsive to them suggest an re-acceleration as base case

However, the risk of growth accidents remains, as corporate toplines may slow more rapidly than cost. It needs to be monitored closely

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

I have little to add to my most recent posts. As the Fed guides to rate cuts, it pushes trillions of US Dollars in Money Market Funds to a search for a new home. This creates a panic bid into risk assets that is likely still well under way, and may only peter out at meaningfully higher levels

I have deployed the remaining capital held back for some possible weakness following Friday’s options expiry. That did not occur, suggesting to me that there are few things that can stop this train possibly until mid-January the earliest as we go into a seasonally very favorable window

Again, the re-adjustment necessary is of spectacular extent, Trillions of US Dollars wanting to leave short-dated, cash-like maturities. I think the odds are high that it brings back inflation via higher commodity prices, but I see all assets benefit to some degree until that is the case and long-term bond yields rise in response (we are not anywhere there yet in my view)

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Good article Florian. Maybe, I like it bc of the confirmation bias!

Three additional factors for re-acceleration:

1). US single family homebuilding is on fire with falling rates;

2) we will get another round if COLA indexation in January (not as bug as last year but still sizeable)

3) its an election year. Economy is not allowed to go into recession.

This is good, very good