On Private Credit

Why it is not a bubble. Plus how I've decided to hedge for the still existing Q2 risks

As regular readers may have noticed, I had mentioned a few times that I’d been wanting to write a piece on Private Credit. The day finally has come, and today’s post discusses this investment strategy, a rapidly growing niche in an asset management industry otherwise shaped by maturity and consolidation

In the below I explain why I think Private Credit is not a bubble, why I find CLOs particularly interesting and what the pushback to this conclusion would be

As always, the post closes with my current outlook on markets, where I explain why I shifted some of my equity exposure into the Swiss Franc, as a compromise to account for both the possibility of further US Dollar debasement as well as the liquidity air pocket that may still affect markets in Q2

Until recently, I had perceived Private Credit mostly from the sidelines, via articles in the financial press that highlighted its rapid growth. This changed when I started working on a new project, where a financing aspect is involved and I realised that the role traditionally filled by banks was now filled by private lending funds

Always interested in the makeup of financial markets as well the driver behind its returns, this piqued my curiosity, so I decided to dig further and see what’s behind. So let’s dive in

To start, we need to define what Private Credit actually means:

While the field is wide and there is no official definition, I would frame it as follows - Private Credit includes all sources of debt outside of banks, public markets or government, typically provided by private investment funds who use their investors’ money to allocate loans to whoever demands them

If we look at the growth of this asset management strategy over the past two decades, we see a parabolic curve, with total AUM more than doubled in the past few years

More so, the typical Private Credit fund advertises returns between ~10-15% p.a. This is notable due to several features that make credit a different animal in particular in comparison to equities

To start, this is significantly higher than the return on global equities, which appreciated c. 8% p.a. over the past 50 years. However, credit ranks higher in a company’s capital structure. In case of default, lenders are first in line to receive funds, and subordinated equity may be wiped out. So very broad credit strategies should typically see a return below equities

For the same reason, credit typically also performs very differently in times of crisis. While all assets may sell off during an adverse market event, credit will “pull back to par” unless a default is at hand, while equities can continue to trade below pre-crisis levels for years

Compared to its “sister strategy” private equity, for many private credit strategies there is also no capital that needs to be held back by investors for capital calls, where the investors’ realised return can end up being significantly below the funds’ advertised return

So for a broad credit-based asset class to see higher returns than equities over a considerable amount of time is highly unusual, to say the least

So where is the supply-demand mismatch coming from that appears to drive Private Credit returns?

Before we get to an answer, let’s recall the following: Asset class returns have a lot to do with demand and supply. To take an example, equity hedge funds in the late 1990s had 25% IRRs running simple long/short strategies. Today, these same strategies have ~2-4% alpha, as much more capital, both steered by humans and computers chases these returns

With that in mind, I believe the answer is two-fold:

The first and biggest reason has to do with banks and regulation. The Great Financial Crisis in ‘07/’08 as well as the Euro Crisis in ‘10/’11 cost global taxpayers trillions to cover losses at financial institutions that messed up their risk taking and blew up. The governmental answer was “never again”, achieved through regulation. Capital requirements were dialled up and banks were generally discouraged to take risk (Basel III etc.). Their retreat left a huge void

The second reason has to do with access to public markets. We see that high yield debt traded on public exchanges typically returns ~3-4% less than its Private Credit counterparts for the same credit risk. However, this market is only accessible to large issuers who can fulfil the burdensome requirements involved in a public debt listing, from ratings agencies to roadshows or exchange fees. At the same time, the potential buyer pool is anyone with a brokerage account, from retail to pension funds

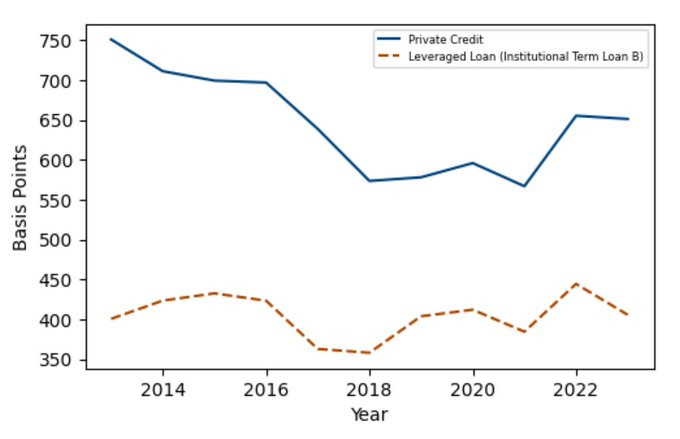

With this in mind, looking at the chart below, the return spread between private and publicly traded loans for the same risk starts to make sense

Private loans see high issuer supply as banks don’t want to cater to them, and seemingly still not enough demand from Private Credit funds

Publicly traded loans see restricted issuer supply due to the high threshold to access public markets, while demand is practically unlimited

Summary: Looking at the context outlined above, my common sense answer is straight forward. The explanation for the excess returns of Private Credit can be found in a vast supply-demand mismatch that hasn’t been filled despite the strategy’s rapid AUM growth

In my view, the surest tell-tale sign for maturation or even overheating could likely be found in Private Credit returns compressing further, and possibly aligning with public market returns

Diving deeper, we can divide Private Credit broadly into the following four disciplines:

Direct lending. This involves a corporation taking a loan from a private credit fund at individually negotiated terms and accounts for the vast majority of AUM

Asset-backed financing. Examples include a lender providing upfront cash in exchange for the future cash flows of an asset such as utility bills, consumer car down payments etc.

Distressed debt. This strategy mainly involves buying existing loans that are at risk of default

Collateralised Loan Obligations (CLOs). Here, various loans of the same risk profile are bundled together and then sold to investors

Direct lending, asset-backed financing and distressed debt all appear self-explanatory to me. If one wanted to invest in these asset classes, either directly or via a manager, one has to do the homework of assessing the risk taking, loan quality etc. It is similar to investing in an equity mutual fund, there are good and bad ones and manager quality will matter a lot

Instead, I want to expand on CLOs which I find particularly interesting for their incentive structures

As mentioned, in CLOs several loans of a similar risk profile are bundled together into one asset

In addition, as visible on the chart, they include an equity tranche by the CLO’s manager that serves as first loss buffer as well as incentive for the manager to get the risk right

Further, a lot of the underlying loans are typically related to private equity owned companies, which will fight to keep their equity alive, come with a below average probability of nefarious activities such as accounting fraud or similar, and are generally well run

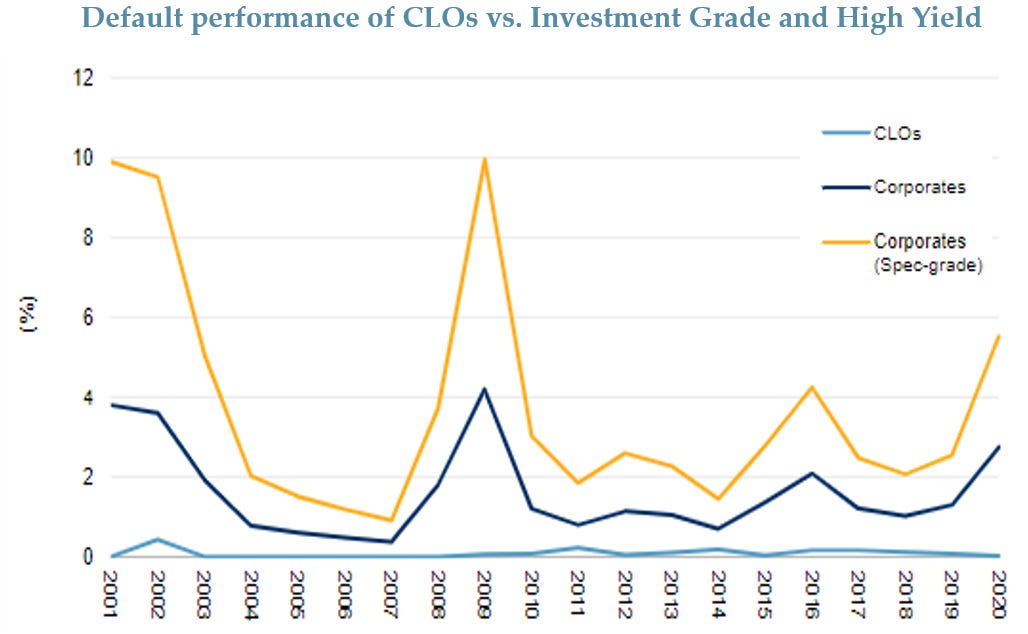

While the CLO terminology evokes bad memories of the related CDOs which blew up during GFC as they were stuffed with subprime mortgages, they performed very well during said period, with barely any defaults despite enormous economic distress.

Summary: Due to their incentive structure and performance in previous performance during downturns, CLOs stand out as particular area of interest within Private Credit strategies

To conclude, nothing is ever perfect or easy in investing, and there are a variety of pushbacks to Private Credit that I want to walk through in the below:

Very high recent strategy inflows: I would look at the spread of similar credit quality between public and private loans as possible signs of oversupply and do not see it as an issue yet

Poor underlying credit quality: It is absolutely possible that some managers chose assets poorly and their portfolios are at higher risk. Thus, nothing replaces the legwork of careful due diligence, this also includes the investor in private credit funds

Looming maturity wall: In the coming years, a lot of debt that has been termed out at low rates during Covid will need to be rolled. With many private credit funds sitting on significant dry powder, this seems more opportunity than issue to me

Private marks are unrealistic: This is certainly an area of concern. With no public benchmark, managers can set the marks on loans wherever fits them best rather than what is actually the case. The irony is that many investors prefer that anyways, as they also won’t have to show losses then. I would point out the pull-to-par as relevant dynamic here as write offs only materialise in defaul, and again the need for individual due diligence

Hyperinflation: If inflation escalates to very high levels, any credit investment gets run over as inflation outpaces even high interest rates. I find this outcome possible, but unlikely, and need to point out that most private debt is floating, which would benefit from higher yields within realistic reason

Summary: Private Credit strategies are not without risk, and anywhere with fast growth someone will have gotten undisciplined. Private marks are another area to be mindful of. More broadly, even with this strategy benefiting from the supply-demand gap outlined above, there is never any substitute for close due diligence

Conclusion:

Due to the supply-demand gap left by retreating banks and the inability of public debt markets to fill this void, Private Credit strategies have over the past decade consistently achieved equity-like returns with credit-like risk

The persistent yield spread of private credit over public loans of similar quality suggest that despite the substantial capital inflows this inefficiency has not yet been arbitraged away

Within Private Credit, CLOs stand out as seemingly attractive strategy given their incentive structures and low historic default rates

Like any investment strategy, there are also many risks that need to be taken into account. Rapid growth makes good manager selection and close due diligence critical, while private marks may at times be misleading

My special thanks go to Gerhard Grüter, a Private Credit specialist with decades of experience whose multi-family office Tropea Asset Management focusses exclusively on the strategy. He generously offered his time and insight to get me up-to-speed on this topic for today’s post. He has published extensively on the topic here

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

While I’ve been long equities this year in China, Germany and Oil majors, and had gone long US equities at the lows in late October ‘23 when the QRA surprise came out, I had clearly sold the latter too early, and then avoided them this year due to their relentless ascent

With Powell’s super dovish press conference on, I changed my view on them and went long. Since then, I couldn’t shake the feeling that many had exactly the same thought at the same time, which was also supported by the reactions to last week’s post, of which there were many and mostly confirmatory. As such, I have to accept that I, like many others, was possibly “stopped in” and simply capitulated to a seemingly never ending rally, while Q2 risks are in fact still the same, in particular the liquidity drain I had highlighted in “On Liquidity” (see slowing decline in Reverse Repo facility below, likely to eventually grow again in Q2)

At the same time, I cannot deny that last week Powell clearly told us that he doesn’t care about inflation risks and sees his emphasis squarely on the labor market, all in the context of a persistent 7% government deficit. There are few scenarios that scream to own assets more than the combination of a dovish central bank, lingering inflation and a spendthrift government

Still, with an unknown future, we also have to accept that there is a scenario where Powell is simply right, whatever the probability is. Perhaps the downside risks to the economy are underestimated or perhaps inflation is indeed seasonal, or at the very least takes much longer to resurface, and rates should be cut quickly

How do I square all these probabilities with my “original sin” of having sold US equities way to early after the turn in October, and the risk of having gotten “stopped in” again at the highs? This is the compromise I’ve come up with - while keeping some, I’ve decided to trim my long exposure in US equities and instead roll it into a Swiss Franc long position, for the following reasons:

The Swiss Franc reflects one of the world’s most responsible and prudent government and monetary finances, yet it has lost 8% in value vs the US Dollar year-to-date. With the SNB’s rate cut last week, perhaps that move is now done, the currency can return to its more gold-like historic profile, and if the US Dollar keeps getting debased against most other assets, this should also include the Swiss Franc from here

At the same time, should we indeed see a moment of equity weakness, due to the Q2 liquidity air pocket or whatever other reasons, the Swiss Franc may be bid due its traditional flight-to-safety characteristics

In other words, the Swiss Franc could work in either scenario, risk-on and market weakness

Should market weakness materialise, I can simply roll the Swiss Franc exposure into long equities e.g. towards the end of the weak Q2 liquidity window. If markets rally, my remaining risk exposure plus the Swiss France should help

I’ve maintained the exposure in gold/gold miners, Tesla and some US equities. For Tesla, I see the frequently cited headwinds to EVs at this time, but in my view this is really about autonomous driving, with a call option on humanoids further out. I do think the progress in FSD 12.3 is very impressive, and future upgrades should increasingly bring the bull case around autonomous driving closer. As always, I could be wrong, please always do your own DD and use stop-losses

Related to this, one of my coming posts will be a two-part series on AI, first checking in on the current development state and future outlook, followed by an introduction to the already existing possibilities in corporate use

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Thanks for the analysis on a new sector (to me). Very insightful.

Given that you give runaway inflation a slim chance, it feels a bit irresponsible that you don’t hold a minor (few %) Bitcoin allocation in your portfolio. The risk is very asymmetric, and with a small allocation the volatility is muted.

Thing is with CHF, the SNB are the only major central bank that’s cutting rates. It’s a currency that trends strongly, it trended up for a long time prior to this year. It may be a good call with a longer time horizon though.