Stable Coins

The missing link between crypto-hype and mainstream adoption?

In last week’s post I introduced a business idea that uses blockchain technology to bypass online-payment and advertising monopolies, thereby creating substantial savings for consumers and e-commerce businesses. Much of this use case rests on so-called stablecoins. Today’s post expands on their role

Stablecoins are virtual representations of traditional currencies such as the US Dollar. They combine several advantages:

In contrast to Bitcoin or Ethereum, their prices don’t fluctuate as they are tied to their real-world counterparts

The currencies they represent are established means of payment and accounting that everyone is familiar with

They are programmable, which makes them flexible, instantaneous, easy to implement and versatile across borders

This segment of the crypto-world has seen explosive growth over the past year, however, with ~$135bn market cap, it is still a fraction of the overall space

There are two categories of stablecoins:

Centralised stablecoins claim to hold a “real-world” dollar in reserve for each virtual dollar created

Tether is the biggest and oldest offeror with ~$60bn market cap. It originates from the early wild-west days of crypto and, while claiming to be fully backed, has never provided a conclusive audit

USDC, a JV between Coinbase and Circle, Paxos and Gemini Dollar by the Winklevoss twins are all offerors that emphasise credibility and provide regular auditing by Wall Street firms. Unsurprisingly, they are now growing much faster than Tether

Algorithmic stablecoins rely solely on complex code to keep virtual and real-world prices in equilibrium

This holds some intellectual beauty, as neither reserves nor a centralised instance are necessary

Equally, this is the biggest weakness. Protocols can contain bugs or they can be malignantly hacked. In some instances, this has lead to dramatic losses

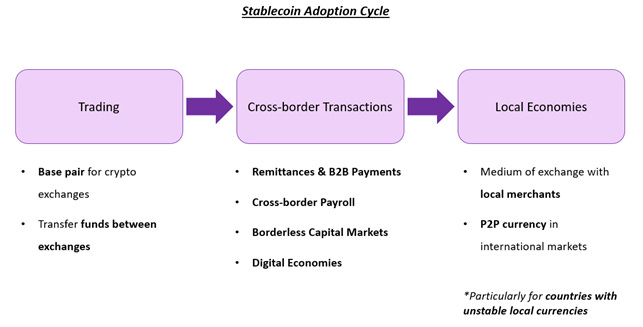

The versatility and ultra-low cost of stablecoins provides many areas of application, as outlined in the chart below

Today, stablecoins are mainly used for liquidity provision in crypto-trading. This could be for currency pairs (e.g. BTC/USDC) on decentralised exchanges like Uniswap, or for market makers who need inventory to trade etc.

Use cases are emerging in remittances. I had mentioned how El Salvadorians pay $400m or ~8% of what is sent back home every year to remittance handlers such as Western Union. Facebook just announced an app to provide remittances between Guatemala and the US at zero cost, based on the Paxos stablecoin (USDP)

The long-term market potential is huge. Just as a point of reference, the global Eurodollar market, i.e. US Dollars that are held outside the US banking system, amounts to 20 trillion USD

In particular in e-commerce, stablecoins hold huge promise with their ultra-low cost and instantaneous settlement

Last week’s business idea built on the premise that consumers could be attracted with high yields on stablecoin deposits

Once on the platform, they would be offered cashbacks in online shopping

This would be possible as e-commerce firms pass on their savings from cheaper payment rails as well as avoiding google for customer acquisition

In other words, consumers come for the yield, stay for the cashback

The current market rate for US Dollar stablecoins ranges from 7-10% p.a. for overnight lending to institutional counterparties1. Compare that to 0% on most bank accounts

This naturally puts questions into the spotlight: What is the source of these high returns? How safe are they? How sustainable?

Now, while the crypto-market size is $2.6tr, it is still a very young market and ripe with inefficiencies. Keeping this in mind, these are the sources of institutional borrow demand:

Market makers require borrow to provide liquidity and offer inventory, just like for traditional securities

Participants in decentralised exchanges such as Uniswap or Serum require borrow to capture the fees offered for maintaining currency pairs

Hedge funds and investment banks participate in market-neutral arbitrage and require leverage to do so. This ranges from trading Bitcoin futures vs spot to triangulating currency pairs or exploiting regional and exchange inefficiencies

Parallels come to mind with commodities and equities markets in the 1990s, which were much less efficient at the time

And equally, institutional crypto-lending and borrowing has high similarities with the traditional capital markets business of investment banks such as JP Morgan or Goldman Sachs

In good times, these are highly profitable. But the risk is all about the black swan events. Just like subprime mortgages went to zero, it could also be that Bitcoin collapses

Typically, all crypto-borrowing is collateralised and institutional borrow demand is for market-neutral activities

While for DeFi protocols collateral is the only insurance, centralised institutional crypto-lending firms also apply the traditional rules of credit origination, e.g. assessing the counterparty’s balance sheet strength, credit history etc.

Genesis, which is the institutional market leader with ~$16bn outstanding loans, did not experience any defaults in the various Bitcoin crashes (such as Black Thursday March 2020 when Bitcoin dropped 50% in one day), suggesting well executed risk management

The high interest rates in institutional crypto-lending are a reflection of a sector full of inefficiencies and starved of willing lenders.

Just with traditional capital markets lending, any credit losses are a function of risk management

In a black swan event, I would expect several of the lower quality offerings to go out of business, while well-managed desks should see limited damage, if at all

One day, according to economic logic, the high interest rates in crypto-lending should align with interest rates elsewhere. However, at the same time, technological progress should produce more use cases, suggesting new opportunities could offset this alignment

Traditional consumer loans such as college loans, deferred taxes or mortgages could be offered on blockchain rails as assessment metrics like credit scores evolve. The market for consumer loans is $11tr USD in the US alone

Treasury and institutional cash management are further big logical extensions

Over the course of the next decade, central banks will likely turn into stablecoin issuers and replace private sector offerors. CBDCs (Central Bank Digital Currencies) are nothing but stablecoins, just issued by governments instead of Circle or Tether

Conclusion: Stablecoins are the key to bringing blockchain innovation to everyday consumers. They are also the building blocks of a much more efficient financial system. For now, they provide attractive yield for investors who understand the risks

It is even higher, 12-14%, for lending to retail counterparties. This is mainly leverage for directional bets. While these loans are typically 150-200% collateralised, the sustainability is unclear and I’ll leave this on the side for now