The Importance of Agency

On Germany's Gas crunch, and a silver lining

Over the past few weeks, Russia has cut its gas supplies to Europe by 60%. This is particularly painful for Germany, where gas is the #1 input good for its industry, and which has increased its dependency on Russia over the past two decades

This post provides some historical context, assesses the impact on Germany’s domestic economy, and looks to a silver lining from the current situation. As always, the post concludes with an outlook on markets

A few weeks ago, under the pretext of turbine issues, Russia dramatically cut its gas supplies to Germany. These currently reach the country via two pipelines

German economic minister Robert Habeck subsequently declared:

This is major, as not only is natural gas the #1 input good for the German industry, it is the third biggest source of its electricity generation

Irrespective, one might wonder, why is Germany still buying gas from Russia? Russia is at war with Ukraine, and Germany is an ally of Ukraine

Indeed, Germany’s payments to Russia are a significant source of income for the Russian Treasury, which at the same time is funding said war

How does that make any sense? Germany sends billions of Euros of military aid to its ally, and at the same time wires billions of Euros to its enemy. And then, to add insult to injury, it is Russia cutting Germany off, not the reverse

Now, there are two ways to look at this:

A purely rational view revolves around economic damage, which will be severe. By not cutting imports when the war started in February, Germany had another four months of precious gas supplies, which saved jobs and income at least for that period. And it covered the winter months, when gas demand is much higher:

But humans are not rational. They are heavily influenced by emotions. By not giving a firm answer first, and then see Russia cut off supplies anyways, Germany has lost its sense of agency. And while no economic model can calculate what that’s worth, it equally comes at a cost

Before I expand on this, let’s briefly review what losing Russia’s gas supplies means for Germany

Energy is the basis of all economic activity. Germany covers 30% of its energy needs with imports from Russia. These include gas, oil and coal. Oil and coal are easy to transport, so substitutes can be sourced from around the globe. Gas is different, it only comes as vapor through pipes, or in liquified form required specialist facilities (LNG). Germany does not have LNG import facilities

So Germany’s gas imports from Russia are its Achilles heel. They cannot easily be replaced. In the short run, therefore, the only way to adjust is by reducing demand

Let’s look into that for a moment

Germany needs gas for its households (~30%), for power generation (~30%) and for its industry (40%). For each, different dynamics apply

Households can save by heating less, by taking shorter shower etc. None of this will be popular, but there is some scope for more efficiency. Power generation is helped by restarting coal power plants, and frankly I think it’s likely some nuclear will come back.

But where it will be really painful is for Germany’s industry. For many companies, not having gas is a huge issue, as it is a pre-product in the production process. This includes ammoniac/fertilizer factories, glass manufacturers, aluminium, steel, paper mills, etc. Here, switching to an alternative is either impossible, or requires costly remounting

Much of the potential economic damage stems from these industrial issues. The range of estimates is wide, should Russian gas be cut off entirely. The CEO of BASF predicts an apocalyptic GDP decline. BNP Paribas’ more measured estimate sits at a ~4% GDP loss and a 14% industrial production decline. Whatever it may be, one just needs to look at 1-Year forward German power prices, which assume further gas supply issues, to know things will be tough

So no doubt, there would be serious economic pain. And it is no coincidence that Putin timed his attack at the West’s weakest moment

With high inflation and high indebtedness, in recent history, especially Europe’s vulnerability has never been greater

One cannot underestimate the degree to which central bank policies contributed to this weakness. Money is a virtual reflection of the value of our efforts, and our “Money” has been manipulated to extremes. This occurred on either side of the Atlantic, from negative interest rates to extensive stimulus cheques

At the same time, commodity-rich Russia finds itself in a very comfortable position, despite headlines around its recent default. This was triggered by clearing issues due to Western sanctions, and not its inability to pay

For Germany, said weakness was compounded by enormous strategic blunders, from its much debated Nuclear exit to not trusting its own Allies on the threat from Russia. In hindsight, they appear obvious and are now criticized by many (e.g. current Der Spiegel cover, “How We Got Addicted to Putin’s Gas”)

But while today it is easy to lambast its leaders, Angela Merkel back then and Olaf Scholz today, one needs to keep the following in mind:

First, Germany’s grim WWII history still weighs heavily on its shoulders, and with that the sense of guilt, in particular towards Russia. During World War II, half of the 60 million victims were Russian, and the atrocities on the Eastern Front are unforgivable

Second, Germany’s relationship with Nuclear is shaped not only by its proximity to Chernobyl in 1986, but also by its role as frontier state during the Cold War. With thousands of either US-Pershing or Russian-SS20 nuclear warheads on either side of inner-German border, the country would have been instantaneously wiped out in case of war. The early 1980s peace movement against these warheads gave birth to the Green Party, which is part of today’s government

Finally, democracies are popular rule, either by elections, or by public opinion polls and lobbying. Germany’s leaders implemented what the country told them it wanted. And decisions like the Nuclear exit following the Fukushima catastrophe of 2011 were exactly what Germans wanted at the time. By the same token, 70% of Americans were in favor of stimulus cheques in early 2021, and now 70% of Americans find inflation a “very big problem”

Let’s now turn to the silver lining mentioned in the introduction. Historically, in times of stress and pressure, much innovation has occurred. As such, the current crisis may serve as a catalyst similar to these historic examples for quantum leaps forward in development:

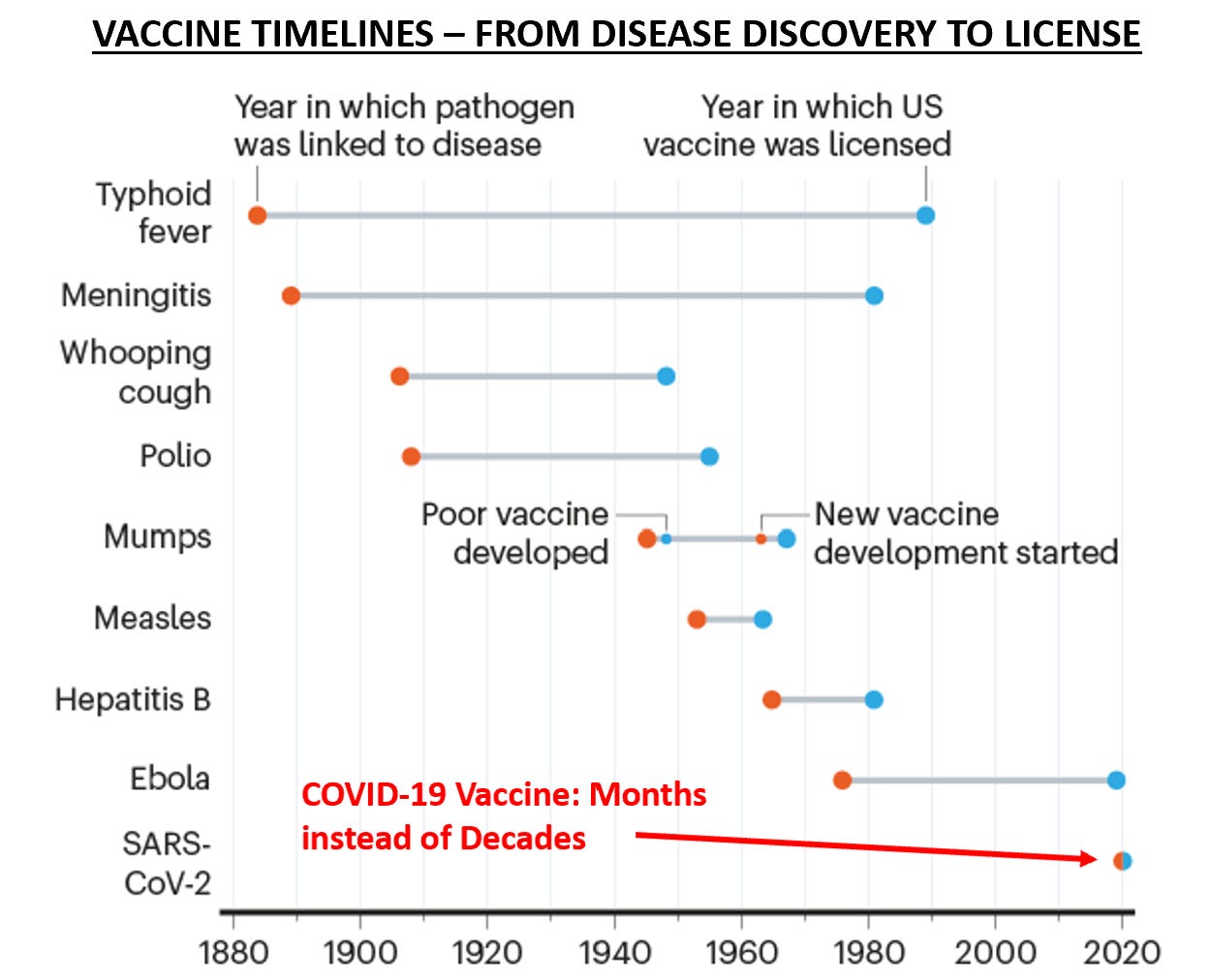

1- COVID-19 Vaccines in 2020

Regardless of how safe one might think the COVID-19 vaccines are, they saved millions of lives of especially older people, and in the face of a global pandemic, were developed unbelievably fast

2 North Sea oil production in the 1970s

Following the 1973/74 oil embargo by several Arab nations, the UK and Norway accessed previously impossible subsea oil reservoirs in the North Sea, adding vital barrels to global production. This likely also contributed to the decline of global inflation in the early 1980s

3 Synthetic Fertilizer during WWI

With saltpetre from Chile, the only established fertilizer at the time, cut off from Germany due to the Allied sea blockade, the domestic industry replaced it with synthetic nitrogen fertilizer invented in the Huber-Bosch process. As seen in the chart below, this later provided a huge boost to world population

Today, the world faces the huge joint-challenge of excessive energy consumption and climate change, another heat record has just been logged for Europe

Germany, with its long history of engineering and deep pool of creative talent is now in a position where it has to come up with solutions to improve both energy demand and supply

And good things have happened already, such as a country-wide train ticket for only 9 Euros, which was introduced on the 1st of June. Over 7 million of these have been sold in its first week, and while trains are full, much carbon and energy has been saved

Conclusion: Instead of being passive and taking the path of least resistance, with the same outcome, Germany and Europe need to establish a sense of agency that energises their domestic economy and talent. The first step in that direction would be to cut the remaining Russian gas supplies, instead of waiting for Putin to do it anyways

What does this mean for markets?

Europe’s difficult energy supply situation mostly amplifies existing trends. A brief summary of some effects:

Energy Commodities- With gas in short supply, Europe will reach for readily available alternatives. This increases demand for coal, and to a limited degree also oil. Both oil and coal are in short supply and their demand inelastic, as it is linked to transport and power generation. These sectors are late cyclical and even then, only decline in harsh recessions

Global economy- Regular readers will be familiar with my - currently - negative views on the economy (e.g. here). Europe is the world’s second largest consumer block, any turbulence will further weigh on the existing global slowdown. However, it is unlikely to alter its trajectory, which is dictated by the US Consumer

All other commodities- While demand for coal and oil increases, the cyclical slowdown will put pressure on all other commodities, from aluminium to steel or nickel and zinc. Food/Fertilizer are the obvious exception and share dynamics similar to oil/coal

European interest rates - Higher energy and power prices (see above) will further accelerate European inflation, aided by continuous high deficit spending. The latter is relevant, in times of high inflation government deficits add to further inflation, as all debt is newly created money. While the Biden administration has acknowledged this, there is little sign so far of similar conclusions in Europe. This will keep upward pressure on European rates

With regards to markets, this is my current attempt at connecting the dots:

I maintain the negative view on cyclical sectors discussed here or here. These have underperformed the recent modest rally, and in light of rapidly deteriorating lead indicators I expect them to continue to do so. I’m staying short Homebuilders (XHB), US Airlines (JETS), DAX, Materials (XLB), Metals & Mining (XME, SXPP), European Banks (SX7P), Semiconductors (SMH), Ethereum and Nasdaq 100

The Oil physical market remains very tight. High refining margins and record high time spreads1 indicate demand for the actual product remains strong. In my view, the sell off in oil was driven by recession fears and crowded positioning, and now the path of least resistance for oil is again up

This will put upward pressure on US rates. These are torn in two directions, with recession fears weighing on yields, and inflation fears pushing them up. A higher oil price shifts focus back to inflation fears. Add to this rents which are still increasing at a fast pace. Also, the labor market is still very tight - the layoffs in Tech get much airtime but amount to only 21k people. I would think bond yields remain in some back-and-forth around current levels, unlikely to go much lower and struggling to break out above recent highs

Any upward pressure in rates however likely weighs on High-Growth Tech. In addition to downside earnings risk, this is the reason why I don’t buy their current rally - yet

Two weeks ago, I had mentioned Energy equities as a sector of interest. On Friday, after a ~25% selloff, the opportunity seemed ripe and I established longs in XLE, OIH and SXEP

As discussed, I believe the upward tension in oil will only break late in the cycle, so the steep sell-off in these names provided a good entry point. While in my view still a good risk/reward, this trade has now moved somewhat, you can also follow me on Twitter where I posted this view already on Friday. Please keep in mind, I may always be wrong

Finally, in my view, the market is likely to turn up when either the Fed relents from its hawkish policy stance, or lead indicators turn upwards (or both). Either could come late in Q3 or Q4, ahead of the economy turning maybe in Q1/Q2 ‘23. This might lay the groundwork for a happier ending to the year

I hope you enjoyed today’s Next Economy post. If you do, please share it, it would make my day!

Time spreads compare e.g. the price for oil that is delivered in the current month to oil that is delivered in later months. If the premium for near dated oil is very high, it indicates that buyers are desperate for product, as they do not want to wait for later delivery despite lower prices

Great write-up. I just got turned onto your site from reading about in some other source and I am really enjoying it. You write really well and have cogent arguments to back up your points. Thanks for posting!

Great post!

The consensus market view seems to be that goods inflation has peaked and energy inflation depends on Russia-Ukraine (supply) and China's reopening (potential demand), which leaves services.

Are there any leading indicators you look at for services inflation?