The One-Company Economy?

Plus my latest views on markets

The most important economic event this past week was the release of Google’s new AI model Gemini 3.0. Today’s post introduces this new dominant driver and weaves it into the political as well as investment debate

As a brief reminder for those who missed it, the Next Economy posts are now the regular output of my Dominant Driver Theory work that I apply for my macro investments, articulated in three segments: (I) the current drivers, (II) implications for politics & the economy and (III) implications for markets

Current Dominant Drivers for Markets

Google AI Dominance

On Tuesday, Google issued its latest AI model Gemini 3.0. It is fair to say that it blew well past already elevated expectations

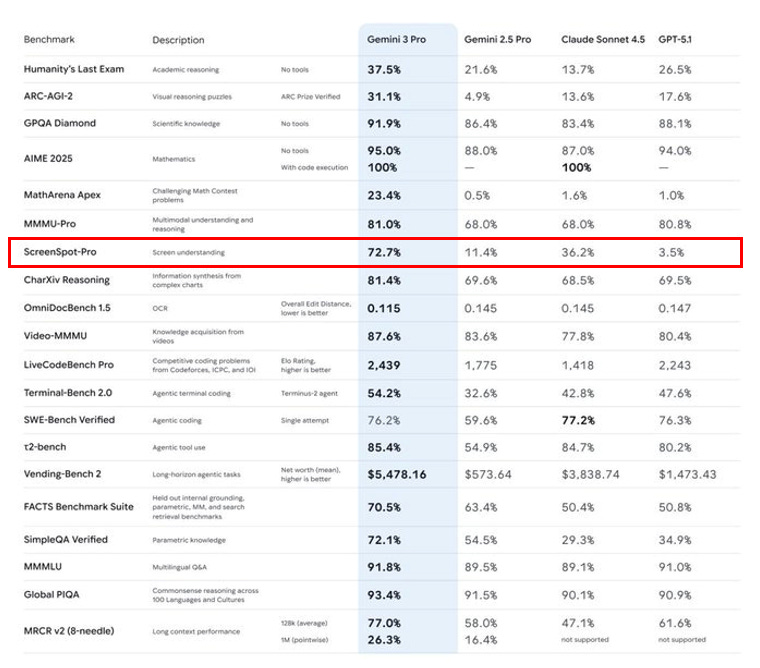

Below table shows its performance across a variety of benchmarks. The most important is probably “ScreenSpot-Pro” which tracks how well a model can read what’s on your screen - highly relevant for the AI agentic work that corporates look for and far ahead of Claude or GPT 5.1

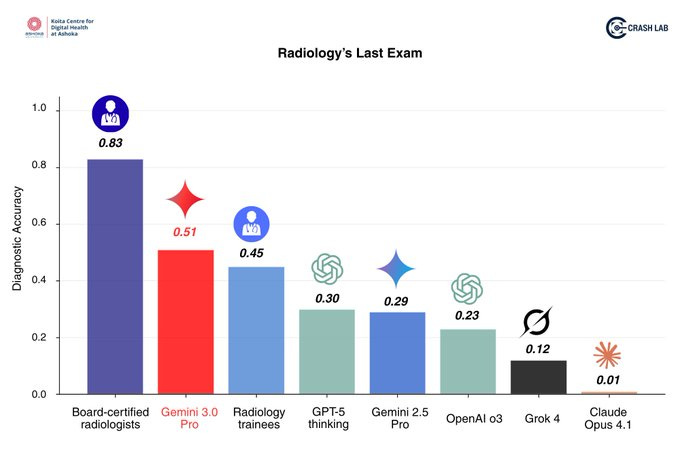

Its release will have immediate impact on many applications where AI already plays an important role, just to take diagnostic accuracy for radiologists as an example:

Gemini 3.0 is currently in a league of its own, which highlights some tremendous competitive advantages that Google holds in the AI race

Google developed the model on its own semiconductors which are ~70% cheaper than comparable Nvidia models. Thus, unlike other AI labs it does not pay the “Nvidia tax”, i.e. Nvidia’s very high gross margins which are everyone else’s main cost => Google has a substantial cost advantage

Further, it owns the world’s largest and most valuable private data resources via Chrome, Gmail, Search and even Waymo. It can combine Gemini 3.0 with all these products, creating a user experience that others lack the ingredients for => Google has a substantial strategic advantage

It has preserved a positive corporate culture that let the sharpest AI minds such as Demis Hassabis thrive and find purpose. This in sharp contrast to e.g. to Meta’s mercenary approach and in some instances toxic social media products or the high leadership turnover at OpenAI => Google has a substantial cultural advantage

Google has pulled away in the AI race. High markets share gains likely follow, and pressure on the competition has been turned up several notches

This has some implications for the themes already introduced last week:

Enterprise AI

As discussed last week, enterprise AI cost savings are coming through faster and more sizable than expected. Clifford Chance axing 10% of its backoffice staff due to AI is another of many recent examples

Gemini 3.0 likely accelerates this dynamic further, the same applies for the Low Income Consumer Weakness theme (cf. “A Political Storm is Coming”) as faster AI savings mean more layoffs

AI Capex

Recall, the market is concerned whether OpenAI will be able to finance its enormous $1.4tr capex commitments. Gemini’s impact here can be seen two-ways:

Positive: Step-change in capabilities proves that AI models continue to scale. Others incl. OpenAI will follow suite soon, in particular once Nvidia’s Blackwell is more widely available, so the worries will be overblown

Negative: Google pulls away from OpenAI and market share losses amplify the existing OpenAI monetisation concerns. Blackwell models take more time and/or won’t yield the same degree of improvement

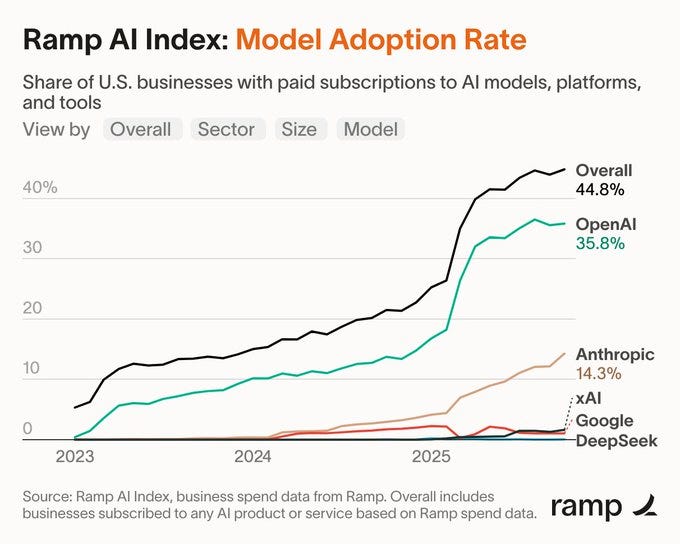

The market is telling me for now it is the latter (see more in investment section). OpenAI is under pressure to produce a powerful response to Google soon, just as it already struggles to fight off Anthropic in Enterprise AI. Given the substantial cost savings (see above) this is the one area where - in my view - there is a chance to fund the gargantuan capex

What Does that Mean for Politics and the Economy?

Two very important dynamics come to mind:

First: Gemini 3.0 has proven that AI capabilities continue to scale, whether via Google or others. This likely increases pressure on the labor market and the persistent weakness in lower income and Gen Z/Millenial consumer groups. The urgency for political change discussed last week only grows

Second: There is a not entirely unlikely case that Google’s moats are so significant that it becomes the “everything company”, as AI dominance could lead to dominance in everything else, from holiday bookings to daily transport. Vined Khosla mentioned a future where AI gains are redistributed to the broad population via a partial nationalisation of listed companies - maybe Google ends up in public hands over the coming decade

If you think this is wildly unlikely, then I want to point you to this quote by President Trump during his meeting with new NYC mayor Mamdami:

In my view it is very clear that the political winds are going to turn much more populist and interventionist. As layoffs continue to grow over the coming months, that change is likely right in front of us

What Does that Mean for Markets?

The following section is for professional investors only. It reflects my own strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please always note, I may be entirely wrong and/or may have changed my mind even by the time you read this. This is not investment advice, please do your own due diligence

Let’s tie the themes together for their investment implications

Equities

As you might recall, last week I had US equities as “underperform” on the twin issues of rising layoffs and OpenAI. This was followed by a choppy week with several aggressive sells

As as result, they are now very oversold on a wide range of metrics. I therefore am now much more mindful of two-way risk for them, and currently see two scenarios from here for US equities, and frankly global risk:

Scenario 1 - Bull Case: Real-time data (e.g Citi/BofA card) and retailer commentary (e.g. Walmart) suggest US consumer spending remains on track, Gemini proves AI keeps scaling and any OpenAI wobbles can be absorbed, the administration and the Fed will support the market (e.g. Williams on Friday), the market is overhedged to the downside and seasonality strong → fundamental logic supports this view

Scenario 2- Bear Case: Layoffs continue to grow and it is only a matter of time until they show in consumption. The admin can’t support that much as e.g. stimulus checks will make affordability worse. Tariffs cause a fiscal drag so liquidity increasingly worsens. The Fed is too late. The AI monetisation question grows in urgency and private credit will see more distress → technicals support this view (e.g. the large head & shoulders structure in the Nasdaq, 21/50 ema cross etc.)

Technicals and the fact that layoffs usually pick up steam once they get going make me think the odds somewhat favor scenario 2. However we are very oversold and there are always lots of bear arguments in the hole

Therefore, this past week, I’ve worked with this information very tactically, first going long risk on Tuesday when it looked like a low was made, then on Thursday I shorted the strong rebound at the open which was short cover and fomo driven. On Friday morning after the overnight puke I went long risk again as it appeared that all dip buyers had given up and despondency was spreading, and closed that once I saw the “AI Balance Sheet Theme” fail to participate in the rally (I’ve shared these views on X in real-time in this thread, these trades are, as most of mine, equity index trades, S&P 500, NQ etc.)

Overall, the Dominant Driver Theory approach continues to work - below is, as before, from 17th Oct 2024

Let’s briefly expand on the “AI Balance Sheet” theme: This refers to the companies that are meant to fund the build out of the huge data center capex over the coming years such as ORCL META MSFT OWL CRWV NBIS etc. If these stocks do poorly, AI monetisation appears more doubtful (and vice versa). Given the importance of data centers to both US stock market as well as US GDP growth, this group is the critical lynchpin

The poor price action on Friday in this theme was concerning to me, as these companies are (I) very oversold and should catch a bid and (II) as in a healthy bullish tape high beta tech should lead and not lag the market

While there can always be a first, it would be an anomaly for a bull market to evolve with high beta tech lagging. Rallies as on Friday lead by value and defensives are historically due to degrossing and repositioning

Thus, the market is telling me that the AI monetisation question remains unsatisfactorily answered, and barring any news I’d think more downside is likely from this leading group, which puts the overall market at risk with it

Given the highly volatile and oversold conditions, we may see a very emotional tape with rips and dips in either direction. Unless AI monetisation is resolved my sense is it will ultimately break lower

Obviously I could be wrong with that read. I’ve been wrong plenty before, and a good streak always increases the odds of it, so keep that in mind

Moving on to other asset classes:

Bonds

My inclination continues to be that US bonds move lower in price as layoffs rise, but I have not traded this view (yet), as the max long CTA position keeps me away. Should the more optimistic scenario above materialise they could also see more downside from here. I patiently wait for a setup

Crypto

Together with other risk assets this has perhaps made a local low on Friday. On the medium time frame however I’d think Crypto likely follows US liquidity flows which I still see as curtailed by tariff revenues. There is also the 4-year cycle theory that many crypto OGs follow that stipulates that Bitcoin made a high for some time in October. Aside from playing short term bounces I see easier asset classes for now

FX

The BOJ intervened today to keep USDJPY from reaching 160. Historically, the market has often tested these levels multiple times. I’d think this situation is not over yet. It could lead to an interesting, assymetric setups in the weeks to come

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Great writing!

How do you definitively state that the BoJ intervened?