Inflation and Asset Prices

A burning social critique in light of recent Fed policies

As regular readers know, I spent much of the past months exploring the opportunity set for AI within SMEs (cf. my last post “Service-as-a-Software”), an idea that I now see increasingly proliferate through the VC ecosystem (e.g. this Craft Ventures post on AI buy-and-build). Still, last week’s FOMC press conference has left me taken aback with what I perceive to be a very unhealthy direction for the US economy. I had to sit down and write today’s post to explain the why and how

My very first post in March 2021 was about inflation and inequality, forecasting the inflation wave that followed. I wrote it not only as an investor, but also because I deeply care about the topic. So it is hard to watch this continued drift into an ever-more bifurcated society, and very recent policy being another big step in that direction

Today’s post briefly lays out why the outlines of a very specific second inflationary wave are now clearly visible. This wave will go straight to the heart of the American Dream, the one of owning a single family home - and if it goes unchecked, it will have serious social consequences as increasingly reckless monetary and fiscal policy transforms the US into an Emerging Markets economy, where asset ownership moves ever further away from the middle class, with political radicalisation to follow

It is important to keep in mind that economic history does not repeat, but rhymes. As such, unsurprisingly, the combination of money printing, a high deficit and a dovish central bank is highly likely to be inflationary. But while in the 1970s oil was the bottleneck, this time it is likely single family housing

Let’s dive straight in. Since December ‘23, Fed Chair Jerome Powell held a decidedly dovish stance in every FOMC press conference. This also included the most recent one, despite a very visible rebound in inflation, even as measured by the understating PCE-gauge

This stance is likely driven by a desire to get ahead of any potential economic weakness, with inflation risks either deliberately ignored, or underestimated

Indeed, there are some cracks in leading employment data, as I had forecast in “Labor Day” in February. Further, wage growth is clearly decelerating as per the chart below

The implicit assumption is that wage growth and inflation are interlinked, and it would require a supply shock to push inflation up again. This supply shock seems nowhere to be seen, at least not in the traditional places (oil, labor etc.)

Now, later in 2024 or 2025 we may indeed get the economic slowdown that Jerome Powell seems to be worried about (I wrote about this risk early in the year). This may just be the inevitable evolution of the ~7-year business cycle

While the Fed cutting rates may not make a huge difference to its evolution, however, the persistent dovish attitude immediately translates into another area - asset prices, from houses to stocks to gold or crypto, much more so than in the past. Why?

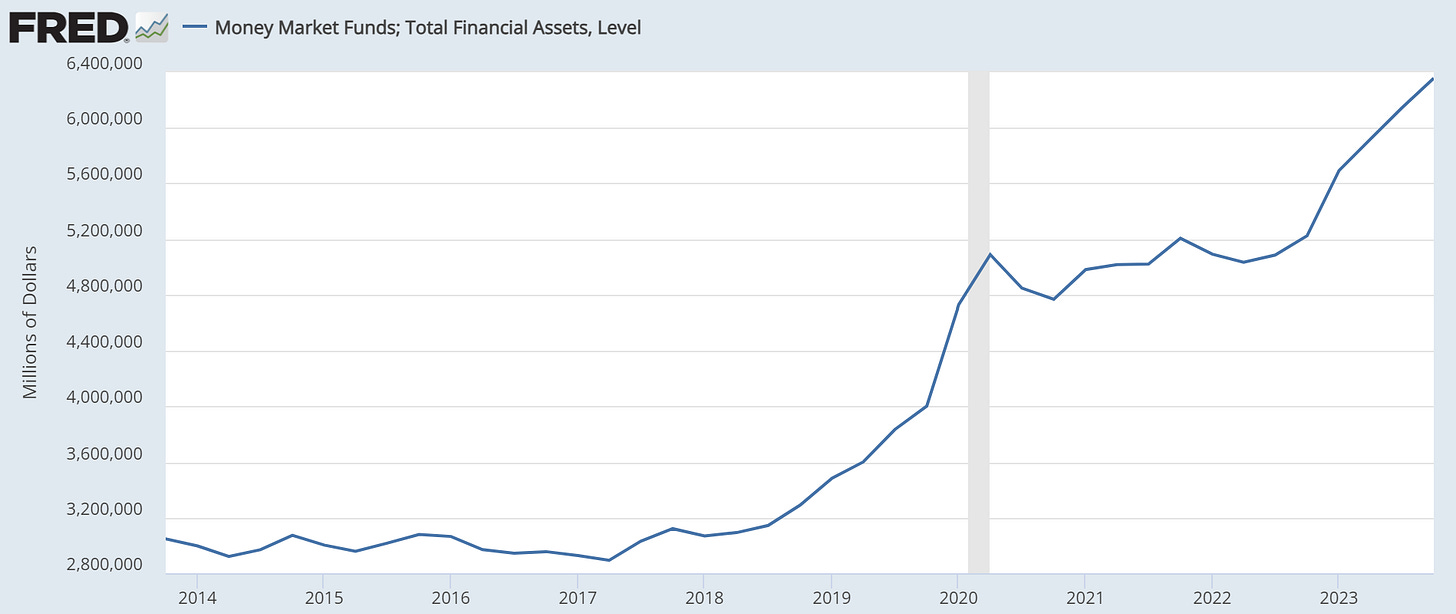

The answer lies in the two charts below, which -simplified- show the amount of “interest bearing cash” in the US economy today

Money market fund holdings, household and corporate deposits (~$2.2tr) amount to a staggering 13 Trillion US Dollars of cash today, compared with ~$4.5tr in 2018. (NB: this ignores T-Bills in circulation which are cash-like)

The Fed dictates the investment intention for this huge pile of cash. If it guides to cuts, everyone wants to rotate out of it into other assets as they see their interest income dwindle. If the Fed holds rates steady, this bid is kept in check

Why does this matter for housing? After all, in the wake of the GFC the link between asset prices and inflation broke. The wealth gap caused by the QE-asset pump created political discontent, but not inflation

In fact, everyone seems so certain of this breakdown that Jerome Powell himself in 2020 famously dismissed any relevance of higher asset prices for his policy choices. A “doctrine” he clearly still seems to adhere to

But Covid and its stimulus splurge changed the makeup of US economy. The private sector went from overlevered to termed-out and awash with cash. Thus, the link between asset prices and inflation is back. Not via stocks, but via housing

Before we explore that further, let’s recall a few statistics about the US housing market:

There are 147m households in the US, of which 31% rent and 69% own

C. 71% of those households are single-family homes, and 29% are multi-family homes

Only 3% of single family homes are owned by institutional investors, vs ~15% for multi-family homes

The American dream is about owning your own home for your family

Let’s look how the cost of this dream has evolved recently, specifically via home prices, real-world rents and rents as tracked in the CPI (OER-Methodology)

Starting with the obvious first - home prices

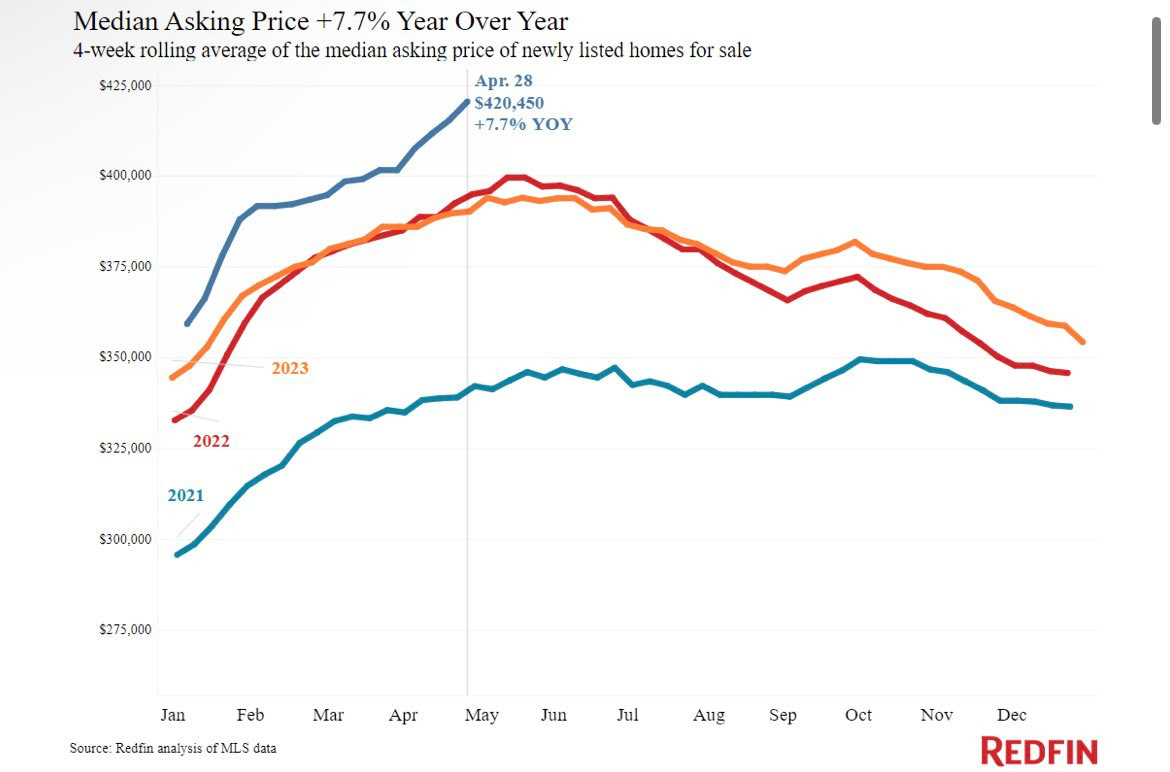

Home prices have been on a tear since the Fed pivot in December ‘23 and are now up 7.7% ytd (!)

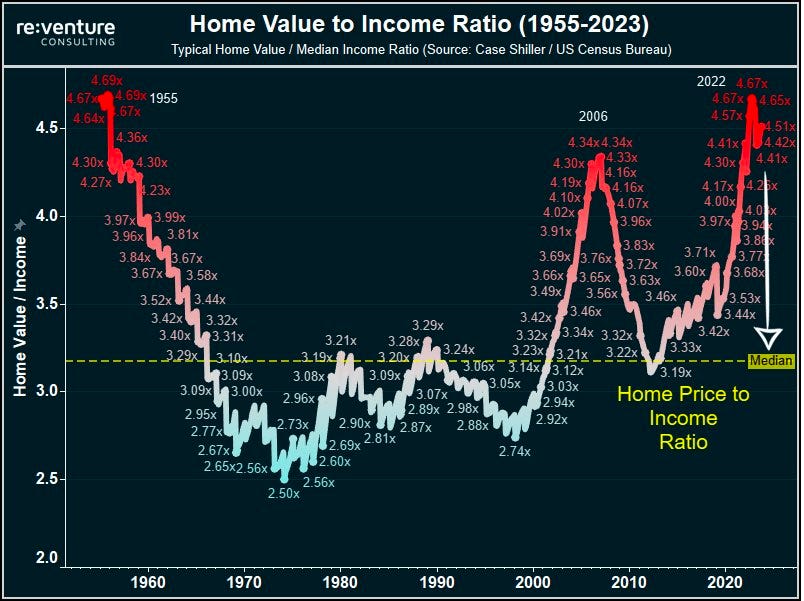

This means home affordability continues to track out of control. How can anyone afford to buy a home then? These are subsidised via asset price gains, often in the parents’ portfolio who then help finance the purchase

Summary: US house prices are on fire, despite 7-8% mortgage rates. They are highly likely to squeeze significantly further if rates are cut

However, home prices are not part of the CPI (they were in the 70s via mortgage cost, but the methodology was changed). So in order to maintain a dovish policy we can pretend this doesn’t matter and look at real world rents instead

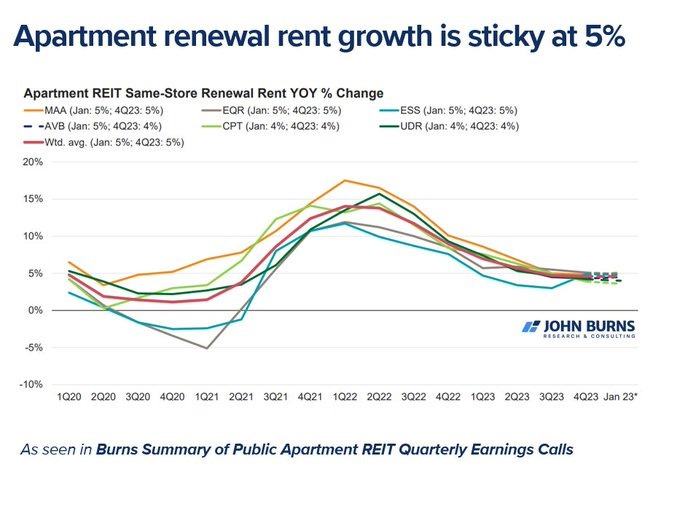

A lot has been made of various indexes showing how new apartments rents are flatlining or below zero, and how that rhymes with decelerating wage growth

But new apartment rents are only a very minor share of the minor part of the US housing stock. First, the major share of multi family rents for obvious reasons is renewal apartment rents. These are tracking at a pretty solid 5% p.a….

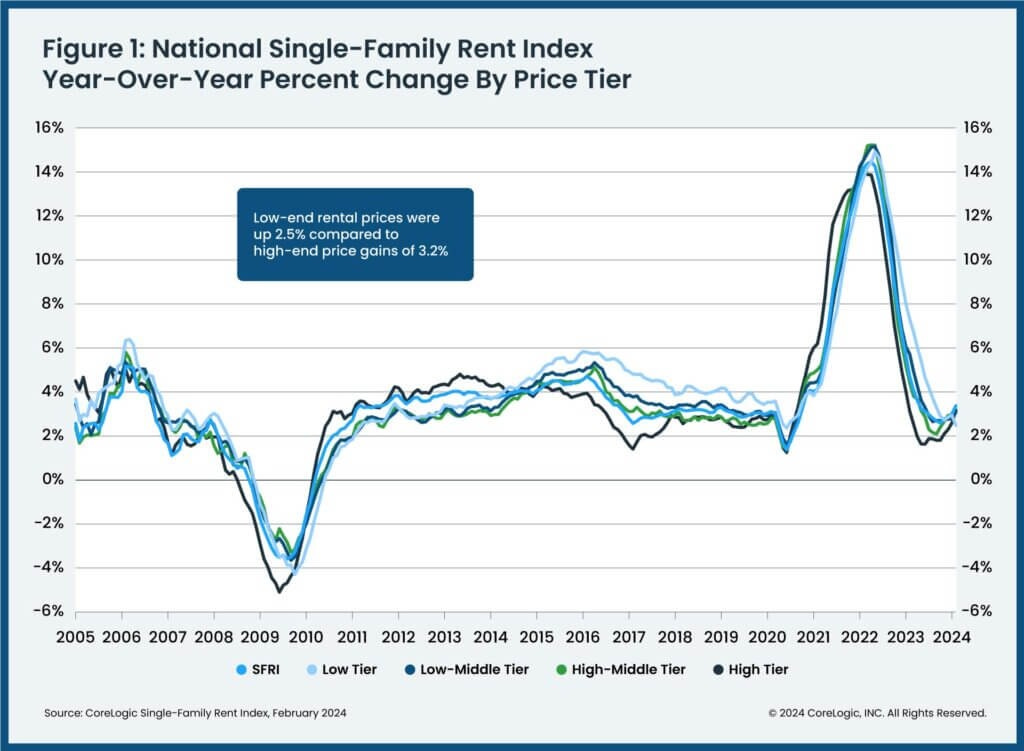

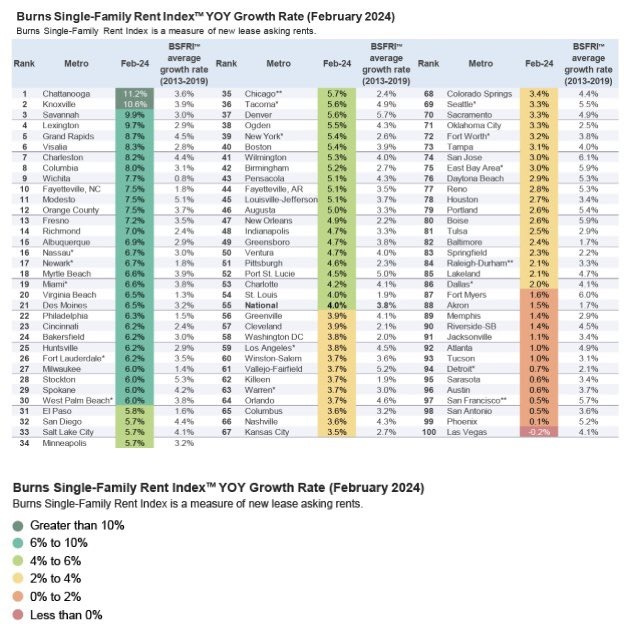

… but more importantly, recall the statistics above - America is about houses. And new single family rents are on the way up again, despite decelerating wages

As the chart above shows, February new single family rents have turned up and are tracking with 3.8% p.a. This average is dragged down by low income homes and the sunbelt, with many metro-areas running way above. (Meanwhile, renewals single-family rents, again the vast majority of single family rents also track at 5-6+%)

Importantly, more near-time information is available via the earnings calls of two publicly listed single family REITs, Invitation Homes and AMH Homes

Invitation recounts improving new rent trends in April and May, targeting again an all-in rental growth of 6-7%

AMH spelled out the same, and wasn’t shy to explain to its investors why it believes single family rents will go up further, as shown below. The left side of the slide lays out the historically well tested relationship between house prices and rents. If house prices go up, rents eventually follow as both markets are interlinked

Summary: Single family and multifamily renewals are tracking at 5%+ p.a.. New single family rents have turned and are approaching 5% p.a. again, with more upside likely given the trajectory of house prices. Only new multi family rents are flat (perhaps <10% of all rents, yet all the press focus is on them…)

It is fair to say that real world rents, which are dominated by renewal and single family, are tracking at an aggregate ~5%, with upside bias. This is way above the Fed’s inflation target and way too high for comfort. Again, for dovish policy purposes we can ignore the real-world data and only look at rent inflation as measure in the CPI index (OER)

Many government inflation measures (such as the PCE index) understate real-world inflation, but interestingly enough the OER-method isn’t too far from the truth. In fact, it follows the Core Logic Index for new single family homes quite closely, as work by great strategist Warren Pies or inflation-expert Michael Ashton has shown (I also recommend @rev_cap’s work who has been an excellent source). Further, as I shared in my last post, the Core Logic index references in BLS inflation papers

However, the OER method has a significant “black box” element. While I assign a high likelihood to these higher rental costs showing up in the CPI statistics over the coming 3-6 months, any individual print can still be skewed by sample rotations or other quirks

Summary: While individual prints are impossible to forecast, it is highly probable that official CPI data will soon reflect higher rent inflation. This is significant as rents account for ~40% of CPI

Ok, so home prices and rents are going up at an uncomfortable pace, aside of the minor market of new apartment leases. But what is behind all that?

I mentioned in the beginning that every inflationary period will have its own bottlenecks. In the 1970s it was oil, now it is housing

The single family home market is experiencing a major supply shortage. This is owed to a decade of underbuild following the GFC now met by delevered households and a Millennial cohort that has reached early-family age

The single family home market is to inflation today what oil was to inflation in the 1970s

Conclusion:

Let’s go back to the Fed’s dovish policies, and why I think they are entirely inadequate in light of this analysis

Should the Fed cut rates, then the $13tr+ cash will want to find a new home and aggressively bid up assets, including single-family homes

This will first hit house prices and, with a lag, rents as many are priced out of home ownership, which will likely see a significant rise of institutional participation

It is highly unlikely that wage growth will match cost inflation. With parts of the population being able to revert to asset gains in order to finance themselves, the squeeze will fall onto lower income groups, increasing the societal wedge between haves and have-nots

In other words, a dovish Fed is pouring gasoline on a supply-constrained market already on fire. This is a market of tremendous social importance at the heart of the American promise of upward mobility, where everyone can make it

The Fed’s policies are shaped by progressive views that put the avoidance of any economic weakness above all, yet in a bizarre combination do not care about pumping the prices of assets held by only a very minor share of the population. The end result is likely that eventually both the economy weakens and the wealth gap goes stratospheric, just like in the many Emerging Market precedents

For the remainder of the year, capital markets are likely in for some uncomfortable inflation surprises that will force the Fed to walk back on its policies. Eventually though, at the first hint of real economic weakness I think it will fold and stimulate, with the above laid out scenario as consequence

In this context, productivity gains achieved by AI are likely our best bet on an exit from the highway to Buenos Aires

Seems like the Fed’s goal is slowly but surely shifting into manipulating financial markets to keep the government funded as long, and at lowest rates possible. In this new paradigm, inflation is good, especially asset price inflation that pumps GDP but not pleb consumer goods that make their way into CPI. These deficits aren’t going anywhere!

Re: AI turning this all around, seems unlikely. AI seems like the classic bubble story atm where we need to see a crash/dis-enlightenment before reaching the “plateau of productivity” where these gains actually make it into the real economy and not just speculative gains. Also, if anything AI is going to massively benefit capital over labor, increasing the haves/nots dichotomy.

"The Highway to BA" might have been missed on some, but rhymes fantastically! Agree that the transmission of lower rates into higher rents is the strongest argument against the 'high rates are inflationary' arguments that are emerging. Great piece as ever Florian.