Is the S-Word in the Room?

A brief market update

Since my more extensive post on Liquidity earlier this week, a flurry of data releases provided us with important new information. Today’s post walks through them and ties it all together to what could lie ahead for the second quarter as well as the remainder of this year

Let’s jump right in this time - starting with the all-important US inflation data released this week

Both the Consumer as well as the Producer Price Inflation print came in significantly hotter than expected. I had pointed the likelihood of this already in late January here and again more recently here

Rather than going into the details, I would just like to apply Occam’s razor and show the below simple chart by the WSJ’s Nick Timiraos:

Whichever way you turn it, the three- and six-month annualized change is clearly moving up. Taking this simple “visual” as cue, it looks like US inflation made a low last Fall

This makes sense when we keep in mind that the global goods economy went through one of the roughest downturns in recent history, as overordering during Covid-19 was followed by a year of destocking across the global value chain. Inventories were cleared at discounted prices and weighed on inflation

This process has come to an end, and goods inflation has likely found a local trough. That doesn’t mean it will escalate again to worrisome levels, but the balancing effect to still very sticky services inflation will likely be gone

Moving on to the Fed, just last week Jerome Powell declared on Capitol Hill that he is “not far” from cutting interest rates. In next week’s FOMC, he will likely be reminded of that comment by the press, in light of the latest strong inflation data. What will he say?

In my view, it is likely that he walks back on those comments. He cannot maintain them without looking like the Central Bank Chair of Venezuela, it is not serious. So he will most likely make cuts data dependent, wanting to see more proof of disinflation, caveating that a better March CPI is likely not enough, which means the odds are that the market starts to price in less than 3 cuts for this year

The inflation rebound may complicate matters for the Fed as I increasingly see signs of slowing growth, in particular in the labor market and to some degree now in consumption

While official headline data remains strong (February NFP = 275k jobs added), many secondary indicators point to a much less benign picture, such as the staffing component of the NFIB Small Business survey

Now, surveys are always lower quality data than hard measures, so one in isolation can always be misleading. However, the same weakness is also shown in a plethora of other data, which the Kansas Fed summaries into one aggregate Labor Market Index

When we look at consumption trends, the tepid picture year-to-date is thus perhaps unsurprising. February retail sales came in below expectations, and near-term data continues in the same vein. Compare below ‘23 vs ‘24 so far

Moving on to asset markets, as laid out in the more detailed post earlier this week, I expect liquidity to be a headwind for the coming quarter

This is due to higher than expected tax payments, negative T-bill issuance (bills are like cash, and ~$225bn more will be repaid in Q2 than issued) as well as the Reserve Repo facility likely getting filled again

At the same time, as usual, active fund managers have gone all-in at the highs, with the NAAIM fund manager survey showing the most extended exposure in over two years. Similar can be seen in prime broker hedge fund net exposure data

Summary:

Inflation is rebounding. It remains to be seen whether it is just a bump in the disinflationary road. But so far, the trend is again up

The Fed is unlikely to ignore said data and likely to lean against it, at the very least relative to very dovish market expectations

The labor market shows too many cracks for comfort. Should these trends persist, expect consumption and overall real growth to decelerate in the near term. Important: Please also keep in my that the goods economy can rebound from destocking while the overall economy slows

Liquidity is likely a headwind for asset markets during Q2. However, once the quarter passes, high bill issuance will return and once again likely prove a strong tailwind

Active manager exposure is at a 2-year+ high

Putting it all together, this is the roadmap I see for the remainder of the year:

In the near term, all of the above combine a narrative that might see the “S-word” re-emerge for the first time since the 1970s. The combination of low growth or even stagnation and inflation, i.e. “stagflation”

This will possibly be used to explain a pullback in asset markets over the course of Q2 that may see its actual origin in temporarily unfavorable liquidity conditions (narrative to follow price?)

As data over the coming quarter perhaps disappoints while all these dynamics reflexively feed on each other, at some point towards the summer the narrative peaks, perhaps on an ugly employment print, while inflation has cooled off again due to said slower growth

This opens the door for both the Treasury and the Fed to pivot back to a fully dovish mode, with the then closely looming election a strong additional motivation. Out of a midyear trough, a very bullish second half for asset markets possibly follows, as the Fed cuts while the Treasury once again pumps T-Bills into circulation. This would also indicate a likely inflation resurgence in ‘25, as fighting unemployment is prioritised over fighting inflation

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

Aside of a small long in Natural Gas futures, which came back to multi-year lows and faces very favorable seasonality ahead, there are no changes to both the short- and long-term book vs my earlier post this week “On Liquidity”. I still have the S&P 500 May puts in the short term book and my intention is to patiently wait for a moment that gets everyone beared up in Q2/summer (possibly on the “Stagflation” narrative) to then go max long for the second half of the year. Obviously things may turn out entirely differently, but that’s my plan

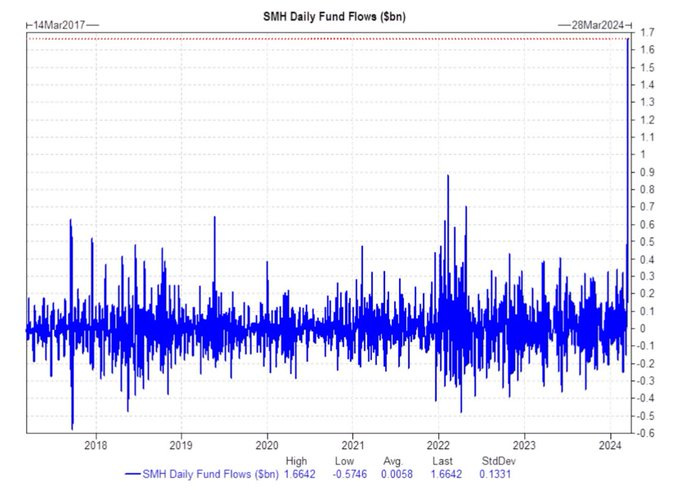

A brief word on AI, as I see many analogies to the 1999/2000 new economy bubble going around. As discussed in the last post, yes, if you buy semiconductor stocks here, you are likely exit liquidity for those that bought much lower and are now trimming. Just look at the retail inflows into the semiconductor ETF over the past days:

Having said that, I do not think that AI is a bubble. In another project I am working on, my team and I can see the tangible benefits first-hand (I will write more about that in the future), and I think it is fair to say that over the coming years the technology will permeate a large share of corporate processes, with substantial productivity gains as mundane processes become much more efficient, from answering costumer queries to prepopulating cumbersome RFPs or matching staffing or transport queries with their ideal counterparts. It is the real deal in my view, and will contribute to global GDP growth over the coming decade in a non-trivial way, not to speak of the more medium-term potential of humanoid robots (see e.g. here)

This major positive will likely be sorely needed in the coming years, as the current trajectory of the US is very concerning. The profligate fiscal spend over the medium term likely translates into both fiscal and asset price inflation, which screws the 40% of Americans not involved in the game. Reducing the deficit via budget cuts seems unlikely given its social implications. Reducing the deficit via taxes on asset-owners is out of the question, as this would cut off the hand that feeds both parties via donations. Accordingly, the choice falls to the invisible tax of inflation, which is disproportionally paid by the poor. If Technology doesn’t bail out the country, then a massive increase in inequality over the coming decade seems likely, with a very bifurcated society much more the hallmark of Emerging Markets such as Brazil

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Thanks for the road map. No one knows the future, but it's good to have a plan.

Great piece Florian! Your liquidity view aligns with Michael Howell quite nicely...