On the Middle East

Sometimes words are hard to find

They came together to dance. Their festival was a celebration of “friends, love and infinite freedom”. They were teenagers who loved life and peace, innocent youngsters who were slaughtered like sheep in the Negev desert by Hamas terrorists who dub themselves “freedom fighters”. In the Kibbutzes not far from them, grandmothers and babies were shot at close range

Sure, the West easily forgets that Gaza is a desolate place. Two million people crammed together on a small, arid strip of land. Every other resident is unemployed with no prospects. Schools and hospitals are few and inadequate, all in close proximity to a flourishing neighbour who they believe has no right to be there. Of course there is conflict. But it is the violence and barbarism that is shocking and inexplicable. It shines a disturbing light on its backers, above all Iran

Hamas’ terror is as old as mankind. Brutalised men with sociopathic traits from the bottom of the societal totem pole filled their disappointing lives with quasi-religious or nationalistic purpose before in the SS, the Khmer Rouge, ISIS or the Wagner Group. All these associations either self-destructed or were annihilated by the free world. This will also be the fate of Hamas. The aftermath will not be business as usual. Israel rightly will not rest until Hamas is destroyed

What consequences to draw from it? War is unpredictable, yet escalation seems likely. More broadly, these come to mind:

Israel will for a generation not trust Palestinians and do everything it can to keep itself safe. Any two-state solutions appears comical now, one is hard pressed to not perceive the 2005 disengagement from Gaza as a mistake

The gap between the West and the unholy Russia-China-Iran alliance once again grows. Russia and China have been uncomfortably quiet throughout this episode, Iran is behind it

In particular, any reconciliation efforts with Iran’s mullah regime now just seem like the West being taken for a ride. Thus, the geopolitical risk premium for oil will rise. Western oil and gas production likely increases again, despite ESG concerns, for strategic security reasons. For sure in US shale, possibly even the North Sea

Military expenditure will continue to increase, it is one of the many facets that underscore my view of a higher inflation decade ahead. Conflict is inflationary, always has been, as money is printed to fund industrial expansion

The spiral of violence and rage has been dialled up again. Just imagine the pain of the families of the past week’s victims. I feel with them, deeply. But peace must eventually follow, as an eye for an eye leaves both sides blind

With respect to this week’s events, I have moved the economic discussion to the next section, where it is this time interwoven with my current market views

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

To summarise my current stance: I’ve gone all cash in early September in expectation of a turbulent Fall, believe the instability in the world’s most important asset market, US Treasuries is very concerning (see “Red Alert”), have opportunistically played equity downside with puts and continue to do so, have become open minded to safe haven assets, and am looking for a wash out in risk assets to go long with margin of safety

What do I see now? Let’s start with positioning, the most objective of all metrics:

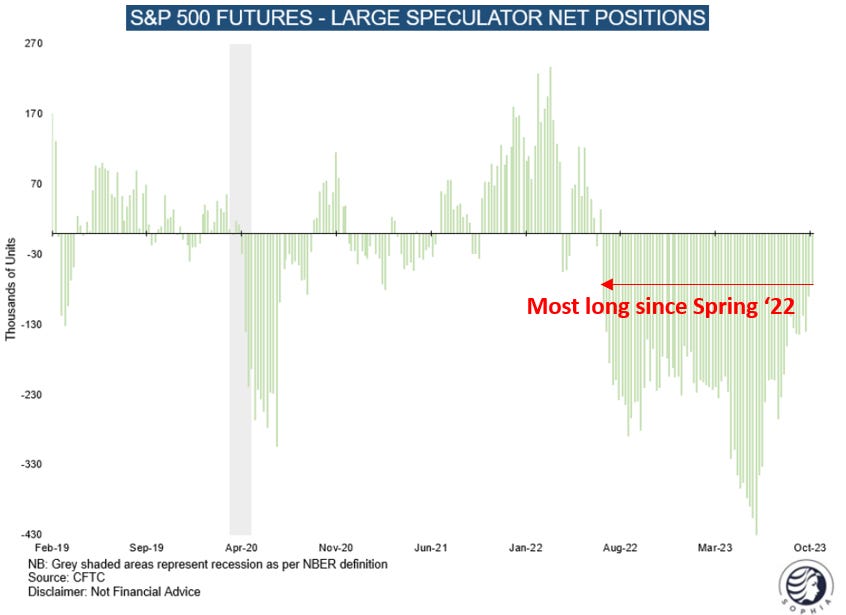

CFTC data for the S&P 500 shows large fast money accounts are the most long in a year, and per last Tuesday (3rd Oct). This likely increased further over the past week as markets rallied

Now, CFTC data only captures some part of the market. Prime Broker colour on equity long/short hedge funds is another important datapoint. These have reduced market (“net”) exposure by aggressively increasing short exposure. However, equity L/S funds are mostly long the “Magnificent Seven” and short unprofitable Tech and small caps. As long as the former outperforms the latter, they have little pressure to take off their shorts again

I do have to acknowledge that retail investors bought a lot of puts recently, yet they barely ever get anything right on aggregate. This contradicts the CFTC data to some degree. Further, CTAs are max short, but keep in mind their overall size within the equity pool is small

Either way, with the longest track record and highest consistency, I put most emphasis on CFTC data, and it continues to worry me for any long equity exposure. It tells me that the market is buying the dip instead of shorting it. Why is that an issue?

It’s simple - More shorts would provide fuel for a sustained upmove, as they’d be forced to cover. However, the inverse is true if the dip is bought - it increases the number of potential sellers in a downmove,

Let’s look at other asset classes. An interesting picture emerges:

CFTC data shows that large fast money accounts have largely given up on safe haven assets. As market structure changes over time, a lookback over the past 1-2 years is most instructive. Here we see the lowest long exposure in Gold since last Fall. It is similar for the Swiss Franc and the Japanese Yen (though is the latter still a safe haven?)

Moving on to bonds, clients of JP Morgan’s Treasury desk remain significantly long US Treasuries, despite the recent sell-off

How can we summarise this? Large fast money investors are broadly long Equities, short safe haven assets and long bonds, relative to a ~1-year lookback. This is not a great context when keeping in mind that the market usually does the opposite of what everyone is positioned for

The opposite would be weak equities and a bid for safe haven assets all while the US Treasury bond market continues to act as a source of instability, until the majority has given up on it

Turning to US Treasuries: As I wrote in last week’s “Red Alert”, their disorderly rise in yields is very concerning and spells trouble for all other assets. While they have caught a flight-to-safety bid on the Israel events and also seen some short cover, yesterday’s disastrous auction in $100bn new 30-year bonds shows little real demand for them

As discussed, the US is raising enormous amounts of funds while the natural buyer universe has shrunk, with banks and foreigners out of the market while the Fed is doing QT instead of QE. This puts pressure on the long end. In my view, there are three ways the US Treasury rout could be solved:

By itself - Depending on certain views on the long-term growth potential of the US economy, one could argue the 10yr/30yr “valuation” is appealing here. I am wary of this argument as the large supply over the next 12 months needs to draw in a lot of buyers from a shrunk buyer universe, so a large “discount” might be needed

Intervention - Long-end Treasuries become a source of instability for the economy, so the Fed intervenes by providing fresh liquidity. This seems a very plausible avenue for me, but likely needs significant pretext

Bad economic data - If growth slows or turns negative, Treasuries at 2.5% real rates become attractive relative to other assets, in particular equities where earnings would decline. That way, incremental Treasury demand would be created and could drive yields down, but at the expense of other allocations. I was previously of the view that this would require negative data releases (e.g. an increase in jobless claims), and so far all we’ve seen is good data.

However, it is also possible that markets front-run bad data (“The market always knows”). This is plausible when we look at the performance of US small caps. As I mentioned in “On Reflexivity” and many times after, it pays to listen to what the market is telling us - this is not a bullish chart:

It tells us that knowledgeable small cap investors perceive the current rate environment to be an issue for their companies. Small caps as proxied by the Russell 2000 employ ~50% of Americans. They are also the clients booking Big Tech’s Ads and software. Their trend is not great and it indicates an increasingly difficult economic context

Thus, my plan remains the same. I am looking for a material wash out in equities that provides margin of safety, otherwise I will do very little and continue to sit in cash (with yield)

In fact, I have done two trades recently. I bought puts mid- and sold them again late September. This week, as equities rallied, I bought puts again, as I had spelled out as my plan in the last post

My thinking is the instability in the world’s most important asset class, US Treasuries, is more important to the downside than some one-sided positioning is supportive to the upside (see above CFTC data vs put buying, equity L/S funds and CTAs). This calculus may be wrong, it’s the risk I take with my view

The equity wash out I anticipate could occur in the coming weeks. I may be wrong, it could have already occurred and I missed it. But I cannot buy stocks with the Treasury instability outlined above and the CFTC positioning suggesting fast money is buying the dip. These two dynamics have to change first.

Some further thoughts:

Bonds - If economic data rolls over, or equity markets roll over in anticipation (see Russell 2000 comment above), then there might be window opening to go long 10yr/30yr Treasuries as the flight to safety caused by recession fears takes place and possibly invites Fed intervention, while high real rates provide margin of safety. But keep in mind, the Fed cutting rates while inflation is still a risk will be perceived as negative for long-term bonds, so it very much depends on the context. Long the 2-yr note or certain SOFR call options could also soon be attractive

Gold and Swiss Franc - As per my last post, I have now become open minded on these, though I do not want to buy them just yet as I do not trust the high in US yields, and with it real rates to be in. But we may be close, as mentioned just above, and within the Israel conflict their demand pattern might also decouple from real rates, in particular in the case of Gold. Further, It will be interesting to see how Bitcoin acts over the coming weeks

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Love your work - thank you. Interesting that prescious metals & USD are both rallying today.