The Playbook

Ten high probability assumptions, and how they line up to a constructive outlook for early '24

With several important data releases and more insight from market price action since my last post “Terra Incognita”, I believe the waters have now somewhat cleared and a most likely path appeared, which today’s post outlines. In particular, I will walk through ten high probability assumptions about the current state of the economy and markets, and how they synthesise to said conclusion

Having said that, it is important to recall that there is no constant in financial markets. The moment a truth gets priced in, it ceases to exist as reflexive feedback loops create a new truth (e.g. slowing economy → lower interest rates → more economic activity → higher rates etc.). For that reason, while today’s post looks into early 2024, it is not a year-long forecast, as it may be invalidated whenever the market prices in these views, which may already be early next year

As always, the post closes with my current outlook on markets. Near-term, I am cautious as retail has once again gone all-in expecting a big Santa Rally that has possibly already happened. Looking into ‘24 however, I am constructive and intend to buy any year-end weakness in both equities and bonds

Let’s dive in - these are the ten high probability assumptions:

The US economy is slowly slowing

For the current quarter, the Atlanta Fed GDP tracker currently guides us to 1.2% real growth, down from 4.5% in 3Q23. This is likely set to slow further. The fiscal impulse that drove much of the ‘23 growth surprise wanes, as social security payments (“COLAs”) won’t rise as much in January as they did this year. Further, state level spending is set to decline

Inflation likely won’t re-accelerate for some time

As the economy slows, inflation slows. Looking at its core reading, we are currently tracking ~2-3% p.a.. Dominant components such as rent or cars are likely to provide further disinflation into 1Q24 as more supply comes to market

The US is currently not in, or on the cusp of, a recession

November’s unemployment rate dropped to 3.7% from 3.9% before, and there is currently no sign in the weekly Initial Jobless Claims or WARN notices that suggest unemployment is about to spike. Without higher unemployment, economic growth is unlikely to turn recessionary

That being said, the labor market is clearly softening. But it will take time

The Fed will cut rates if inflation declines, even if growth is decent

Several Fed governors have told us that policy turns too restrictive should inflation decline, and they do not need to see severe economic pain to cut rates in that case. Tomorrow’s FOMC meeting may be their last truly hawkish showing for this cycle (see more in markets section)

The expectation of lower rates alone will stimulate the economy

As Fed policy guidance is priced into interest rates with immediate effect, this change in “policy attitude” has ushered in a new context for the bond market, where any weakness in bonds (= increase in yields) is likely bought, at least until inflation readings show reason for concern again

The resulting lower yield curve stimulates the economy primarily via two avenues: (1) higher asset prices (e.g. stocks) and (2) more housing activity

Low income households are suffering, but the higher quartiles are thriving

Amidst high interest rates and a lack of savings, the American low end consumer has struggled over the past 2 years. It is unlikely to benefit from higher asset prices, while housing remains unaffordable for many

But the case is very different for the top 2-3 income quintiles, which account for 60-80% of consumption. For them, household wealth is hovering near record highs

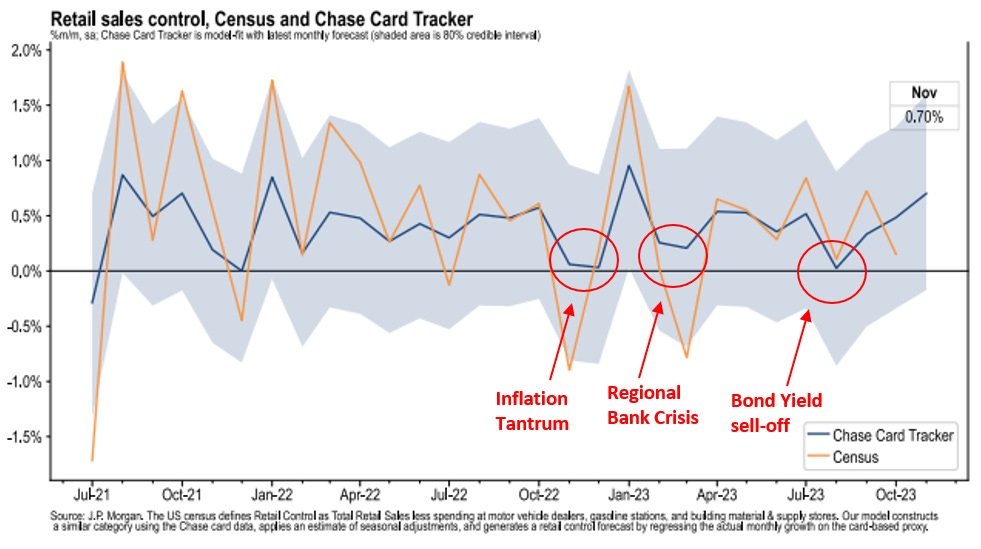

We see the link between asset prices and consumption in the data. Whenever stocks go up, Americans spend more (and vice versa). Below card data by Chase Manhattan illustrates this well

The early cyclical economy is likely recovering

I had mentioned the stimulative effect of lower rates on US housing, which especially for Single Family Homes is a very tight market after a decade of undersupply. To judge this effect, one needs to look no further than at the US homebuilder stock index, which just broke out to a new high. Residential housing is a key early cycle industry, and likely to again contribute to GDP growth next year (vs a drag this year)

More broadly, the goods economy appears to have bottomed out as the large US Retailer inventories have destocked to adequate, or in many cases in fact lean levels.

If consumption holds up, restocking should be in the cards. The subcomponents with lead character within the ISM manufacturing survey (New Orders - Inventories) also suggest this

Some parts of the economy are clearly suffering

While higher rates had a stimulative effect for anyone with high cash balances with interest paid on them, they clearly tightened the availability of capital, which is problematic for anyone with high leverage, low cash flows, or both

The longer that state exists, the higher the damage to those under duress, many of them small businesses. Will we see an increasing number of bankruptcies, as below relationship shows?

Europe and China are in much worse shape than the US

While the US economy benefits from an unprecedented degree of fiscal intervention, Europe’s economy is lacking growth impulses, while China is on an outright deflationary path

However, it is important to keep in mind that the US is the engine of global growth, it will likely set the pace also for these two regions

Most importantly - we are going into a Presidential re-election year

As long as inflation stays low, both the Fed and the Treasury have plenty of room to stimulate the economy. With a Presidential re-election coming up and either fearful of Trump’s return to office, I think their incentive is to lean on the dovish side whenever they are pressed

Irrespective of the election, the societal pain threshold for unemployment is still much higher than for inflation. How low the bar is set for incremental stimulus shows President Biden’s plans announced last week to provide more support for the residential housing market

Summary:

The US economy is slowly slowing, but not in recession. Inflation is unlikely to accelerate any time soon

The Fed will be dovish, which likely supports the top 60% of consumers via higher asset prices and also stimulates residential housing, while restocking likely supports early cyclical industries

Weakness in Europe and China, and delayed effects from higher rates on some consumers and businesses are likely a drag on the US economy

The current administration, and with it the Treasury will fight to get re-elected, and provide economic stimulus. This may prove inflationary, but not in the near term

Overall, a benign picture: Growth slows enough to bring down inflation, but not enough to cause a recession. Intervention is possible and likely, should growth suffer more than expected

Now, the above describes the most probable outcome as I currently see it. But as I have stated many times, in a world shaped by reflexive, interdependent feedback loops there is no certainty. These are the main risks to the outlook above:

The biggest risk I see is on the corporate margin side. Lower nominal growth means slower corporate revenue growth. Meanwhile, especially labor costs may continue to grow at a higher pace. This may create pressure on margins and risks to employment

The second biggest risk I see is in the “long and variable leads” of monetary policy. Capital is much scarcer today than a few years ago and many small companies are struggling to get access to funding at acceptable terms. I have shown the chart above where small business credit conditions lead bankruptcies. How will this relationship evolve?

Further, the damage to consumer may be larger than expected and reach into the middle and second quintile, rather than just the bottom 40%

Finally, I may overestimate the incentive for the government to intervene. Late January the next quarterly refunding decision is due. The Treasury might decide to issue more long end bonds again, driving up their yield

Whatever my view, the most insight will be provided to us by the market. So let’s listen to what is it telling us right now

If this constructive outlook for the economy and especially markets is wrong, we should first see it in the ratio of stocks to bonds. If a recession is close or underway, capital markets should prefer recession-proof bonds over recession-risky stocks

But if we look at VTI over GOVT (total US stock market cap vs total US bond market cap), there is currently no sign of this rolling over. Investors have no fear of recession and still rather buy stocks than bonds

Further, I had shown a few weeks ago how Small Caps were stuck in a continuing downtrend vs Large Cap Technology stocks. It looks like this trend has broken as Small Caps outperform the latter. This would point to the early cycle dynamics outlined above

Conclusion:

The ten high probability assumptions on the US economy support a constructive path ahead. Growth is slow enough to bring inflation down, but not so weak to cause a recession yet, or at all, while the government has all the incentive and capacity to intervene in an election year

However, there are still substantial risks. We do not know when or how they will play out, but the odds are high that some of those will cause some turbulence down the line

Looking into early 2024, this all lines up to a bullish equity market context. I could see a strong start to the year, then a growth scare as some of these risks materialise, to be met with a forceful policy response (re-election year!) and once again buoyant markets

Looking further out, it seems most likely that further stimulus in ‘24 following a growth scare likely brings inflation back later that year, and that could usher in a more severe slowdown/recession possibly in ‘25

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

In my last post, I laid out a balanced set of trades to address what I perceived to be a murky picture at the time. This is how the fared:

The Yen has rallied hard, as predicted (see “Land of the rising Yen”). This seems to have run its course for now as I believe a lot of shorts were forced to cover. But looking into ‘24, especially against the Euro I think the odds are high we see another run of that trade

Gold has sold off, as predicted. The market is very long the shiny yellow metal while the competition with 2% real rates in TIPS is stiff

Oil majors have seen choppy trading, I exited and re-entered these (see below)

Equity downside did not materialise. I sold my puts in time for the squeeze higher, as it became clear that what does not go down eventually goes up

The yield curve has inverted further as the market started to look towards a hawkish FOMC. I managed to take off my steepener position in time for that move

My current positioning is now as follows

I remain short Gold for the same reasoning as before. Note yesterday’s Barron’s cover, which predicts that “Gold prices will climb for the next 10 years”. If it is on the cover of Barron’s, it is often in the price. For gold to work well from here, one needs to believe that real rates will drop sharply. This may well be possible at some stage, but it does not appear imminent. Until then, the “cost of carry” for long gold is high. I think (though as always, I may be wrong) that TIPS are likely a better alternative. As bond yields comes down their price appreciates, while 2% real rates that may stay still for some time + inflation are paid as interest

With regards to Equities, while I am bullish for 2024, the current retail frenzy (most buying since March ‘22 as per JP Morgan) worries me and I think the odds are high that those buying now in expectation of a Santa Rally that already happened are getting rug pulled. We already saw in Bitcoin over the weekend, which has lead the market so far. I am waiting for that moment to build longs into the New Year

In the New Year, we could see Small Caps or the “other 493” outperform the leading Large Cap Tech stocks (Magnificent 7) within the S&P 500. But every sellside note is talking about the trade right now, so again it feels like the odds are it sees a washout first

That being said, everyone seems to have given up on China. As per prime broking data, mutual fund holdings are in the 2nd percentile over the last 10 years (!). I have again built a contrarian position here

Further, I think there is a decent probability that oil has seen its lows for some time. If the goods economy recovers, oil demand should improve as 40% of it is industrial. I hope exposure to oil majors benefits from this, these are also underowned and hated right now

In terms of bond exposure, I am short the 2-year into a presumably hawkish FOMC pushing back against the many rate cuts priced into ‘24 so far, and hope to switch this to a long position in US or German 5-year in its wake, as this may be the last instance for some time to see Central Banks hawkish, and the general trend in bonds should now be on the long side

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

this is a really good exposition of things we probably know, but havent dissected. Thank you!

Enjoy reading your thoughts Florian 🙏🏽