The Tariff Wall Is Coming

The market is oblivious to its biggest risk (but there are some silver linings)

Over the past 15 years, the makeup of equity markets greatly changed. The share of actively managed capital declined, to be compensated for by passive investment vehicles (ETFs) and retail investors. As such, the stock market today is both much more narrative driven and short-term in nature, focussing primarily on the immediate future, in contrast to the historic 12-18 months forward-looking as Stan Druckenmiller often described it

Case in point, at the April lows, the market’s narrative was that Trump’s tariffs would push the world economy into a stiff downturn or even recession. A few months on, the contrast could not be bigger. Tariffs are now seen as irrelevant, and a booming economy lies ahead

Today’s post argues that this will soon again change. Focus will shift back to tariffs, and their likely very significant impact on the US economy in the coming quarters. It also discusses the positive dynamics that could offset that blow and draws a synthesis. In the markets section, I share how I think to trade it

First, let’s quickly summarise the context:

The current US administration has mandated tariffs on the vast majority of its ~$3.3tr annual imports. Via a series of framework agreements or unilaterally imposed, the US now charges a blended rate of ~18-19%1 on the $2.7tr worth non-exempt goods entering the country

This equates to an annual run-rate of c. $500bn new income for the US Treasury, or ~1.66% GDP

What else do we need to know about the tariffs?

Tariff collection within this new regime started in April, but really ramped up over the following months

Tariffs are paid by the importing company in the US, who wires the required amount to the Customs Office which is part of the Treasury. In other words, tariffs are a tax paid for by US corporates

The typical commercial inventory cycle is ~90 days. Thus, even though tariffs have been collected for a bit more than a quarter, companies so far haven’t had to pass any tariff costs to consumers

As their old inventory runs down, this changes. Corporates now have to decide how to deal with this new $500bn burden. Generally, they have three options:

Push the cost onto their suppliers by asking for discounts. So far, there is no evidence that this has successfully happened. We can track aggregate import prices (e.g. here) which are flat year-on-year, and various surveys confirm only minimal suppliers concessions

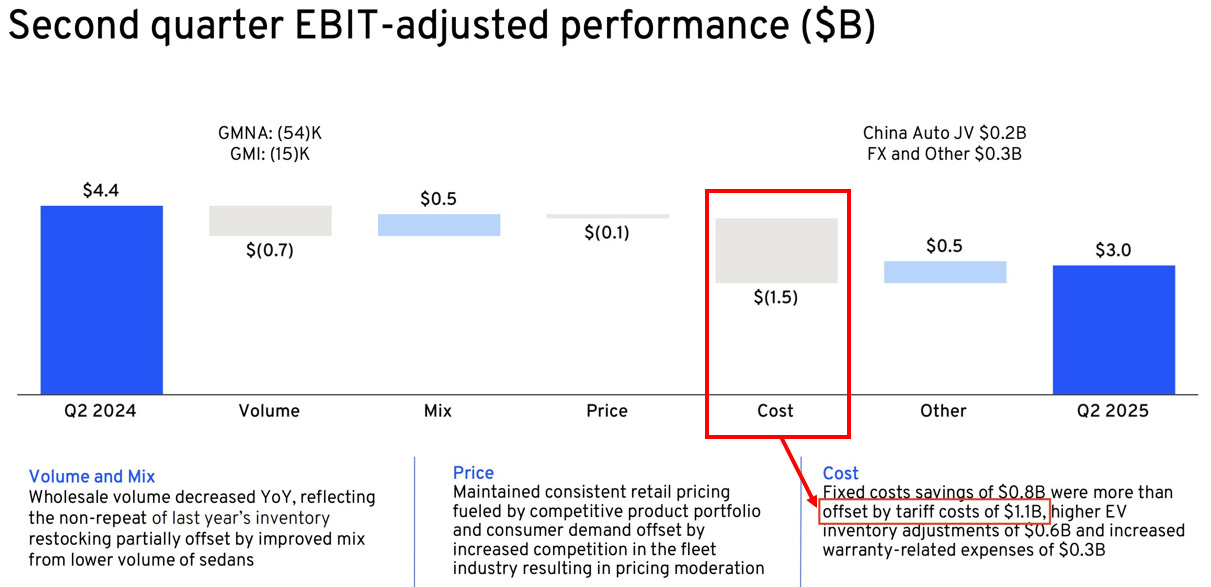

Absorb the cost into their margin. This would represent a ~12% decline on the aggregate $4.4tr US corporate profits. This slide by GM is a good example of what many more US companies would face soon in that case

Source: GM/Jack Farley Push the cost onto consumers. Corporates that have pricing power, or think they have pricing power, will jack up prices

The last point is what we're about to see over the coming month. Walmart and Amazon are moving forward with some very significant price increases for back-to-school season, with other retailers to follow

For consumers, this is a very unwelcome surprise. This kind of inflation is a “negative supply shock”, and in contrast to Covid not caused by everyone having more money available

In fact, wage growth has been slowing for some time. If the prices for some expenses go up a lot while consumers don’t have more money, they will buy less of the same item, or have to cut back elsewhere

In summary, there is no good way out. Either the companies take the margin hit or consumers get fleeced. The tariff wall, at 1.66% GDP equivalent, is about to hit the US economy from August onwards, at full speed

Further, empirical studies show that tariffs are typically associated with another ~0.45 cents of “dead-weight losses” for every tariff Dollar raised as the supply chain becomes more inefficient, so another ~0.8% drag on top

In comparison, real GDP for 1H 2025 likely was ~1.0%

In isolation, the tariff wall impact would be a pretty sure bet that the US enters a stiff recession from Q3 onwards. Growth has been slowing all year, and tariffs would be the classic supply shock trigger that pushes the economy over its skies

However, there are also some very important dynamics that could offset this impact:

The Big Beautiful Tax Bill

Key here is enhanced capex deductibility, backdated from Jan 1st ‘25, which this year alone provides ~$100-150bn of additional free cash flow to US corporates that invest heavily, such as telcos, utilities or the AI data center complex

AT&T in their earnings call this week quantified this effect at $2-3bn for the year, to be reinvested into new projects (rather than share buybacks) over the coming years

In addition, there are individual tax breaks, such as for seniors, or on tips. However, these won’t be available before Spring ‘26

Reshoring

The various trade deal negotiations included a flurry of investment announcements, e.g $550bn within the US-Japan trade deal

Several corporate announcements were also notable, such as the $50bn capex Astra Zeneca committed to last week for the coming 5 years

AI Capex

Hyperscaler investments into AI data centers continue to grow, from Meta’s Prometheus or Hyperion projects to Google’s capex upgrade from $75 to $85bn for ‘25 on yesterday’s earnings call

As a side effect of this demand, power prices are likely to go up considerably in the coming years

Credit Growth

Banks have been lending more this year vs last year, to the tune of ~$20bn per month. This is newly created money that can circulate through the economy and stimulate growth. The positive multiplier on this in comparison to the negative multiplier on tariffs is debated and frankly unknown

Wealth Effect

The majority of US consumption is done by the top 10% consumer which is asset rich. There is an argument that this cohort may be price insensitive on most everyday items. However, US consumption has been slowing all year so I don’t find it convincing

Summary: Various positive dynamics within the US economy are currently taking place. It is difficult to quantify them, but they are likely to provide some offset to the tariff shock. Unfortunately we can only speculate on the degree. Either way, a timing mismatch is likely; In particular, the various capex initiatives unfold over several years, while the tariff impact will be imminent

Conclusion:

The US economy faces a very significant growth hit starting this summer, as the tariff wall and its corresponding dead-weight losses hit consumers and corporates to the degree of ~2% GDP

On the other hand, various supportive dynamics are in place, in particular multi-year industrial investment programs

It is unclear whether these are enough to cushion the growth hit. At the very least there appears to be a timing mismatch, leaving the US economy vulnerable in Q3/Q4 this year

Current Market Views

The following section is for professional investors only. It reflects my own strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

So, how to trade the information above? I mentioned in the introduction that markets have become more short-term, signs of the tariff wall in hard data or corporate earnings are still spurious and being early is also wrong, so timing is everything. As such, this is how I think about equities at the current stage:

You may have noticed the word “capex” several times in the growth supportive section above, and this is what I believe the current narrative in equities is - the reflationary trend across the US (driven by OBBB incentives and AI) and Europe/China/Japan (driven by fiscal stimulus)

This favors further rotation into the very underowned US small caps (Russell 2000) as well as the closely correlated real economy segments (S&P Equalweight/Dow Jones) and their globals twins (DAX/Nikkei), with a special role for China following the recent recession of the Nvidia chip boycott

I am currently long the beneficiaries of this current trend, such as commodity equities, IPPs and Chinese equities. I emphasise currently as we are in the later stages of this equity rally so this view may change at any time (see below)

As I mention already in a post in June, I believe the last leg of this rally is driven by breadth expansion, i.e. the lagging real economy stocks catch up to Tech. This typically forces hedge funds to cover their shorts (they typically are long growth/Tech and short old economy) and thus extending length, while systematic funds (CTAs/Vol Control) go back all in

It is very hard to predict when that has played out. It could be now, it could be next week with the FOMC or QRA, or it could be mid-August. I think we are very close, possibly we are there today. Either way, when this has played out the market’s focus will shift to the tariff issue above, and then (in my view) is it time to move on to the “tariff wall” narrative and look for equity downside

Accordingly, I have bought out-of-the-money September Puts on the S&P 500 today, and I put on an S&P 500 short with a tight stop above yesterday’s high, while I will reduce my long exposure in the coming days/week(s)

Further, below an update on my views shared last time on Gold, the US Dollar and Bonds. Please see my X feed for near-time updates

Gold:

Short term: During the reflation narrative outlined above, Gold faces competition for capital from higher front-end yields. I’d expect it to chop around or drift, but for dips to get bought

Medium term: The current US administration has made it clear that they want to “run it hot”. Thus, I’d expect a very forceful response to a tariff crisis, i.e. many more printed Dollars. I see the medium-term outlook for Gold as unchanged and positive

Bonds:

Short term: The current reflationary vibes are bearish bonds in the short run, but the growth-negative tariff wall is looming large. Chop or some more updrift in yield I think

Medium term: Should the tariff wall not be offset by the various growth drivers I outlined above, then growth and thus yields can drop substantially, perhaps to 3% on the 30-year. I am looking to go long again the 30-year bond on any blow-out move in yield in the coming weeks

US Dollar:

Short term: Higher front end yields as per above can support the US Dollar in the coming days/weeks, but the overhang from anti-greenback policies is considerable. I expect chop around

Medium term: Bar a substantial policy shift the trend is likely further down. While this is be a crowded view, politics > positioning in my view. More so, the US Dollar is in a very vulnerable position *if* market turmoil unfolds in Q3

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Assumes EU framework deal similar to Japan. No deal with Canada so 30% on the non-UMCSA goods, 20% on SE Asia as per Vietnam Deal, 15% all else without deal so far, steel, copper etc. tariffs as announced

What impact on equities, if any, would an early new fed chair appointment who would spend months jawboning upcoming loose monetary conditions once installed as chair?

Thanks for sharing.