An Outlook As Far As One Can See

Introducing a new market narrative and looking into early '26

As the year draws to a close, this last post for ‘25 checks in on the current status of the various market drivers put forward over the past few months. Further, a new one is introduced

I also provide an outlook into early ‘26, which given the many variables influencing the path of the economy I feel is as far as I could go without resorting to generalisation or speculation

Current Dominant Drivers for Markets

Enterprise AI

I’ve introduced the theme of successful AI enterprise adoption here a few months ago when it was mostly either still ignored or heavily doubted. Safe to say that this has now found broad acceptance in the market. Investment banks are putting forward “AI beneficiary” baskets and the recent outperformance of old economy stocks over Tech was credited to “AI earnings efficiencies”

Developments in this area continue at a high pace, e.g. with Anthropic’s introduction of an browser agent that is only a few steps away from doing proper agentic work, and Google’s NotebookLM and NanoBanana making inroads into corporate presentation work (sorry Powerpoint!)

It is safe to say that the AI use case frontier is now moving from coding to the knowledge worker

The enterprise AI theme has arrived into the mainstream which may limit near-term upside, but given its enormous broadness will likely be relevant for years

AI Capex

Equally, the issues around OpenAI’s ability to fund its capex commitments were picked up early on here, with some stocks within the “OpenAI complex” down 50% since (e.g. ORCL, CRWV)

These issues likely remain unresolved until either OpenAI gains significant share in Enterprise AI where the money to pay for the capex is likely made, or the cost of compute comes down a lot. However, with such large stock declines they seem in the price for now, or at least not an asymmetric bet anymore

As discussed, Google remains in a favorable position as consumers increasingly type AI queries into the browser search bar bypassing apps while releases like Gemini 3.0 flash continue to convince

Worries about OpenAI not being able to fund its capex commitments have reached consensus and are -for now- in the price. We should await new developments to judge the further evolution of this theme

Global Fiscal

The most notable development on the global fiscal side is the Bank of Japan’s third interest rate hike in 24 months at its recent December meeting. The benchmark rate is now at 0.75%, however this is still far below inflation which is currently running at ~3%

Markets remain unconvinced of any serious intention as the Japan 10-year bond continues to drop while Asian investors heavily bid precious metals as a safe haven

It seems highly likely to me that Japan provides for some very volatile market episodes in ‘26 as its domestic combination of high inflation and overly accommodative monetary policy appears increasingly unsustainable

NEW THEME:

US Growth Worries

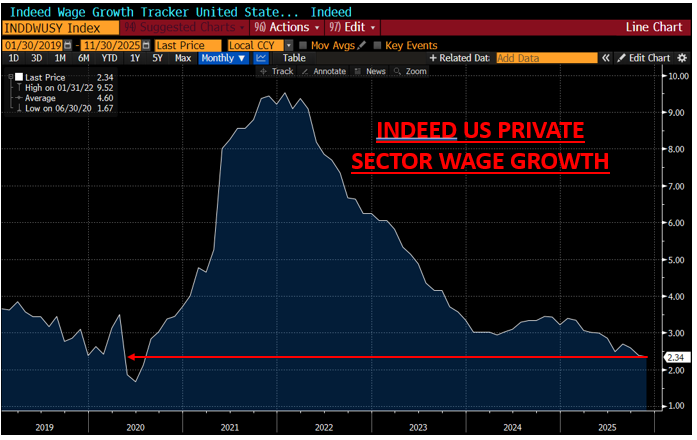

Over the past months, several signs emerged that US economic growth is slowing, including a steadily worsening labor market, the lowest wage growth since Covid and flatlined retail sales since the Fall

Further, the Fed’s interest rate cuts actually remove a significant private sector subsidy, a dynamic completely overlooked by consensus in a high debt/GDP economy. Simplified, paying a 5% interest on 130% US government debt/gdp equals to $1500bn interest payments to the private sector, at 3% this drops by $600bn1

Some offsetting dynamics are on the horizon. The big beautiful bill (OBBB) in particular releases $150bn in tax refunds mostly to low income groups from late January

Either way, early in the year a “growth window of weakness” exists, and we’ve seen early fingerprints in markets of it over the past few weeks

Markets have started to episodically trade a US growth slowdown over the past weeks. This theme seem is in its infancy and may broaden in Q1 until or unless the OBBB funds offset it

What Does that Mean for Politics and the Economy?

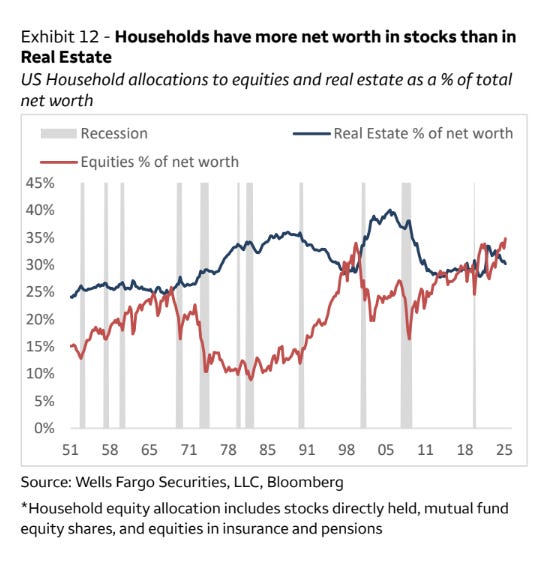

The US economy is very closely tied to its equity markets. These have now surpassed housing as dominant household net worth component, so any weakness in stocks quickly translates into lower consumption and higher financing costs

Thus the urgency to halt and reverse any stock market decline would be high. The US administration in many statements has indeed already flagged it would do whatever it takes for it. Potential measures include:

Sending cheques to low income groups

Cancelling some tariffs, or only reinstall some of those potentially cancelled by the coming Supreme Court decision

Jawboning the yield curve down by increasing political interference at the Fed

Stimulating the housing market, e.g. uncapping the Fannie/Freddie balance sheet so these can hold more MBS and thus compress the spread to the 10-Year

Historically unprecedented policies to soften AI’s impact on the labor market, such as nationalising a share of public corporate equity and redistributing that broadly. This is highly unlikely in the near term, but should not be ruled out for beyond ‘26

Expect some combination of these in response to a market decline, should it materialise. The challenge will be to implement them without stoking inflation or destroying the US Dollar (which would in turn also be inflationary)

Keep in mind: Rising asset prices at the expense of inflation are the most unpopular policy outcome and highly likely would lead to a disastrous Republican midterm result. The K-shaped economy continues to dominate the vibe of the time, as illustrated by the seating plan for the new United 787 plane, where less than a quarter of the plane is assigned to economy (!)

The US administration has shown to keep a close ear on these currents, and it would not be totally surprising if some redistributive tax proposals are picked up, as Mitt Romney has just floated them

What Does that Mean for Markets?

The following section is for professional investors only. It reflects my own strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please always note, I may be entirely wrong and/or may have changed my mind even by the time you read this. This is not investment advice, please do your own due diligence

Let’s tie the themes together for their investment implications

Equities

Projections covering the entire year ‘26 are habitual and the staple of sell-side strategist. However, I cannot with seriousness provide a forecast that far. Why?

As modern economies have become more complex and technological advances much more rapid, the fan of outcomes even looking out even 6-9 months has widened enormously. How will AI progress in ‘26? What policy decisions will be made in response to market events? If anything seems certain to me, it would be that volatility in 2026 likely goes up, possibly a lot

Staying with year-end equity forecasts, in my view, if forced, the best choice for any strategist is to predict a 10% increase in the S&P 500. Stocks go up in 75% of years and roughly by that amount, so over time you’ll be right 3 out of 4 years

One could then extend this concept of generalisation to make safe calls on other asset classes such as “don’t own US Dollar cash as it devalues with 7% p.a. on average” or “own productive assets as its stewards are incentivised to advance them over time”

The second best choice would be to take the strategist consensus and pick a target in opposition to that. This as the consensus reflects aggregate positioning which means it is in the price already and thus likely wrong (see more further below)

So moving to the outlook for early ‘26 which is as far as I feel I can see, where do I stand:

Since my last post, stocks rallied from very oversold conditions to then dip again just as everyone positioned for a Santa rally too early. I waited for that dip to go long into the swing low this past Thursday anticipating that Santa would now actually come this time (see here)

I still hold some of that long exposure, however, as per the new theme introduced above, my outlook into early ‘26 is shaped by the new US growth slowdown theme, so I intend to soon position for what I think could be a correction in Q1 of the New Year

Aside of the growth narrative introduced above, here are some additional reasons:

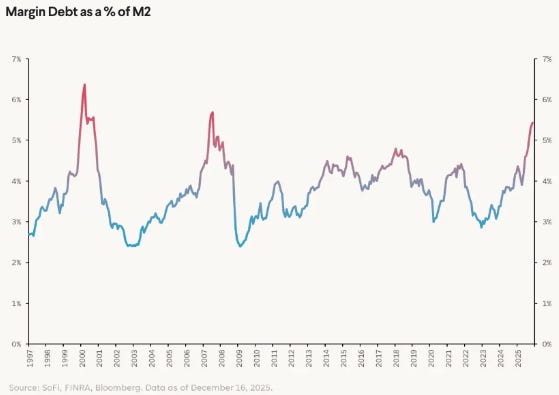

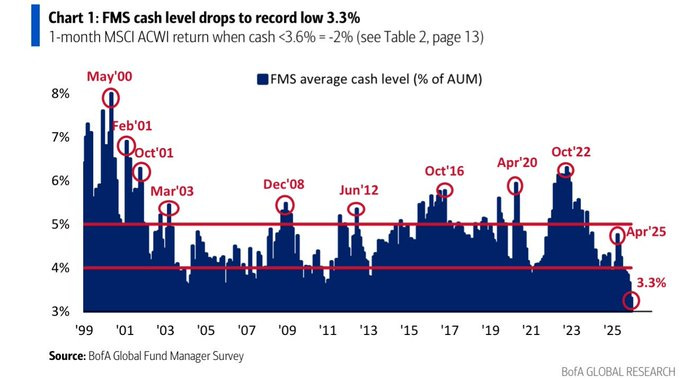

Margin debt as a % of M2 is near all-time highs. Historically this has predated larger sell offs

Hedge fund net exposure is ranging near multi-year highs (though has come off a bit last week as markets sold). Many exposure measures are very stretched:

Most sell side strategists have ambitious S&P 500 price targets, a sharp contrast to e.g. 2023 or 2024

The technical picture in US indices is that of a topping process, with an extended consolidation over the past months and significant block volume suggesting large institutions are reducing equity exposure

Market leaders are currently the Dow Jones and Russell 2000, which historically very often have lead the last innings of a bull market. I think a healthy risk-on tape should be lead by Tech

Accepting that the future is uncertain and I could always be wrong, here is what I would look for to change my mind:

Breakaway momentum from recent all time highs. This would negate the currently negative technical picture in most US equity indexes

A visible change in positioning that suggests enough market participants have turned bearish for the price to go up (e.g. high equity put volume)

Policy announcements that change the fiscal trajectory (e.g. the Supreme Court cancels most tariffs and they are not replaced by alternative means)

A new AI breakthrough

Should we sell in Q1, I also intend to go long into that, anticipating the policy response outlined in today’s political section

Moving on to other asset classes:

Bonds

As discussed here, I have been reticent to go long US bonds as CTAs showed max long positioning and US growth data remained inclusive. With positioning improved, their price retraced and the Sahm rule potentially being triggered with the January US employment data, I am now taking a more constructive view and looking to trade these from the long side. Trade is the right word here, as bonds are never for investing, unlike equities. There is no permanent wealth creation in them, and few assets are as reflexive to their own price changes (lower rates = more growth = higher rates etc.), so always keep that in mind

Crypto

Bitcoin has not been able to shake off its recent lethargy, and the technical picture tells me it isn’t about to either. What weighs on crypto in my view is threefold: (1) reduced liquidity as a consequence of the above introduced growth slowdown theme, (2) still no practical use cases outside Bitcoin and (3) its championing by entities too closely linked with the US government which removes its “rebellious” or at least neutral aspect (e.g. China would not add it to its reserves therefore, unlikely Gold). I do not see sentiment as poor enough yet for a structural low, but could be wrong

Oil

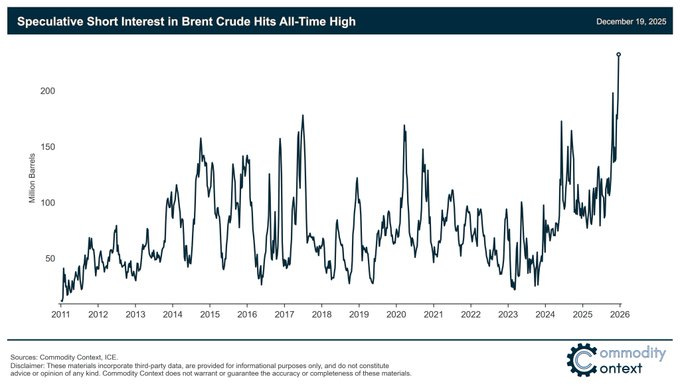

Speculative short positions in Crude and Brent are currently at multi-year highs. I recently wrote that I am waiting for a washout in crude to get constructive on the long side, as the near-term fundamental picture seemed challenging (Ukraine peace (?), oil at sea inventory) but the medium-term supportive. I feel this may have occurred in the past few weeks and I am now trading this from the long side. Over time I would expect higher prices, or at the very least some aggressive short squeezes

FX

As a safe haven from US Dollar debasement and since US front end rates are likely to be cut further thus closing the interest rate differential, I am warming up to the Swiss Franc and waiting for a technically opportune moment to go long (not yet)

2025 has been a good year and the Dominant Driver Theory portfolio since 17/10/24 now stands at +132%. However, nothing ever moves in a straight line, and one of my coming posts will discuss the psychology of drawdowns, how to deal with them and how they can be the best source for growth if used in the right way

I wish all of my readers very happy holidays and merry Christmas to those who celebrate it. See you all in 2026!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, the author does not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

The details are more nuanced as the interest paid depends on the average weighted maturity of the debt outstanding and into what maturity mix the expiring debt is rolled

Thanks Florian, interesting read!

Brilliant piece as always. Very well articulated. Loved the comment on bonds, probably the clearest explanation of the trade versus investment difference. Bravo!