From Secular Stagnation to Secular Reflation

Recapping the case for a new economic era

In 2013, Larry Summers paraphrased the painful economic slump of the past two decades into one fitting idiom - Secular Stagnation. Today’s post summarises the case for the new economic era that might follow - Secular Reflation

Having drawn its outlines in recent writing, particularly last week’s “The Three Blind Spots” seems to have hit a nerve, as I received the highest influx of subscriptions and emails since I started “The Next Economy” two years ago

A warm welcome to the new readers, to whom I would also like to point out “On Reflexivity”, which defines my framework. Its essence applies to today’s thesis - with countless self-reinforcing feedback channels between the economy and financial markets, there is no certainty, all one can do is make a probabilistic forecast. Thus, my thesis is what I think is likely. There are many other possible permutations, which is why also I spell out today what to look for to see if I am wrong

Should I be right, the biggest coming debate will be when and to what degree inflation resurges, with possibilities ranging from the benign outcome of high real and nominal growth to another turbulent spike in prices

With details laid out in previous posts, today summarises the case using charts, so you can scan through it with ease to make up your mind

As always, the post closes with my current views on markets. In line with what I’ve set out, I am now entirely in cash and look to deploy this into US equities aligned with the theme (value, small cap, metals, energy etc) should the market weakness I expect materialise

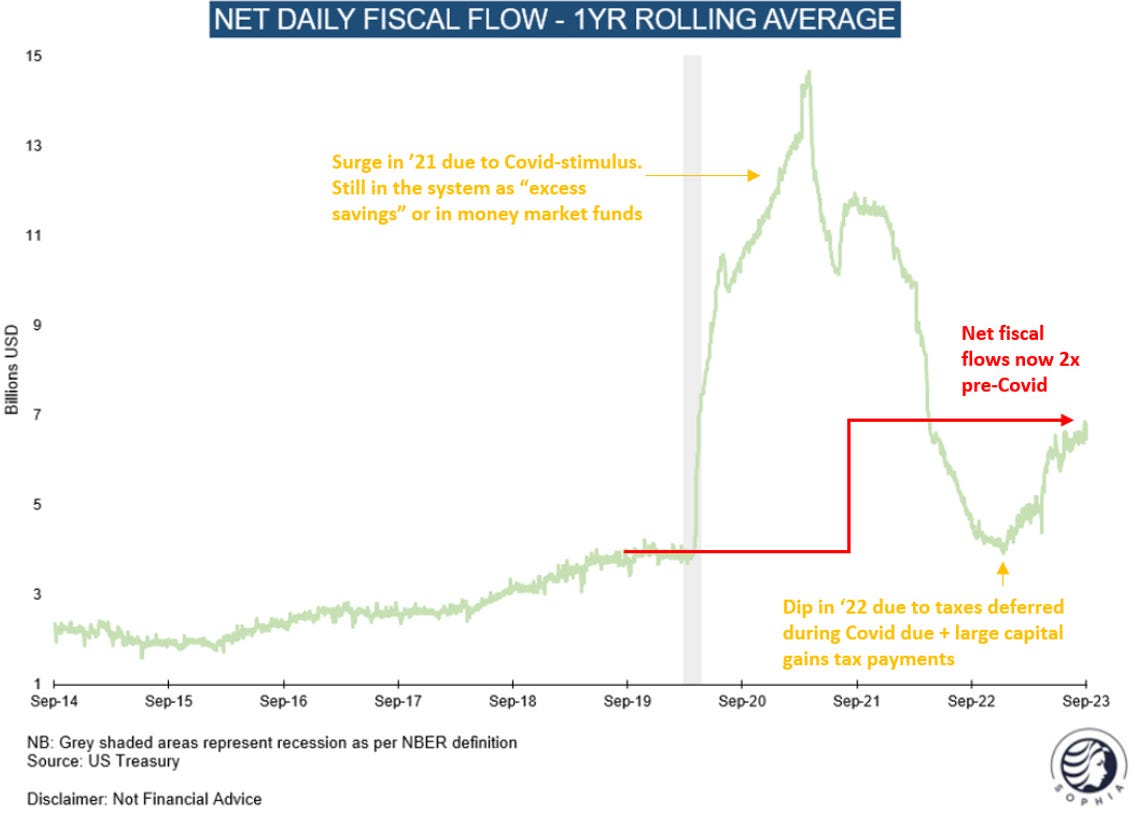

Let’s dive in and start with the most important chart of all - the evolution of the US budget deficit over time

Today, the US is running a war economy, only comparable with WWI and WWII, And contrary to these periods, there is currently no sign of budget consolidation on the horizon

In fact, net daily fiscal flows are 2x pre covid – a game changer for the country’s economic fabric. Why is this meaningful?

Simple - someone’s spending is someone else’s income. Meanwhile, the concern of public sector spending crowding out private investments may be years away, after a decade of QE-induced savings oversupply and domestic underinvestment

Spending is set to continue going forward, in part due to broad and generous industrial stimulus programs

The Inflation Reduction Act (IRA) is uncapped, continues to grow and by design triggers additional private investment, similar for the CHIPS and Infrastructure Act (IIJA)

As a result, the country is on the onset of a re-industrialisation boom, with mega projects rising parabolically

Geopolitical trends help this dynamic, in particular the growing Western mistrust in the previous manufacturing base China

It is not only fiscal flows that matter. Bank lending, the other source of “money”, has inflected upwards

US bank loans and leases are growing again, after stalling for several months

This is contrary to expectations - a credit crunch was forecast following the regional bank crisis in March ‘23

Silicon Valley Bank’s demise is digested, and the “sticker shock” of high rates might have worn off while nominal GDP growth runs ahead of Fed Funds rates

The ebb and flow of fiscal and bank flows is highly correlated to economic expansion or contraction - it suggests further expansion

Historically, recessions occurred when either fiscal, or bank, or both flows contracted. Instead, it appears that either are currently set to pick up

But what about the consumer? Household excess savings are still high…

Bank of America data shows savings and checking balances still >~50% pre Covid

On aggregate, checkable deposits are still >~$3tr vs pre-Covid

…and with strong income growth, spending is now again financed from income instead of savings…

Excess savings supported spending into early ‘23, but wage growth has picked up the baton since

Meanwhile, real wages grow as inflation recedes, leaving more money in consumers’ pockets

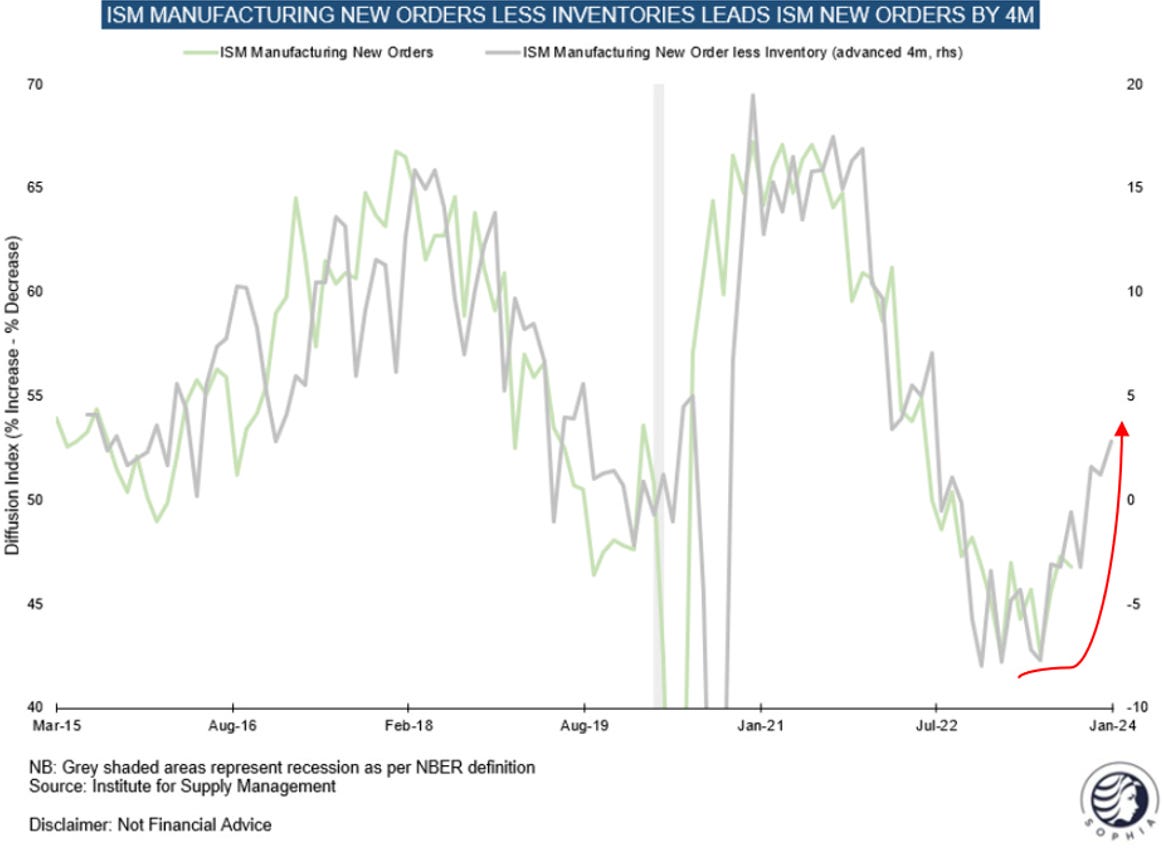

Finally, the US goods economy appears to be turning, which should support growth momentum generated by bank and fiscal flows

Survey data shows an improvement in activity

Survey data corroborated by improvement in hard data so far

The US economy has likely entered the first stages of a high nominal growth world. The key question is – will it overheat?

It might be an outlier, but July Nominal GDP ran at ~9.7% annualised (!)

So what about the Fed? It is likely still too loose, as the private sector has been made immune to rate hikes post GFC and Covid

US corporate interest expense declined by ~$100bn over the past year, despite higher rates. 85% of US corporate debt is long duration and fixed rate

Neither corporates, nor households – on aggregate – are feeling any pain…

Household debt service costs are near historical lows

… at the same time, ~$100bn (and growing) of interest income pours into the US economy every month

Few are willing to acknowledge this dynamic because it is so counterintuitive, but with ~100% debt/GDP, the government is bound to wire ~$1.3tr in interest payments to the private sector in ‘241

So what about inflation? Indeed, some price trends are already concerning…

Gasoline is still doing ok, but Diesel prices have spiked, suggesting food inflation ahead

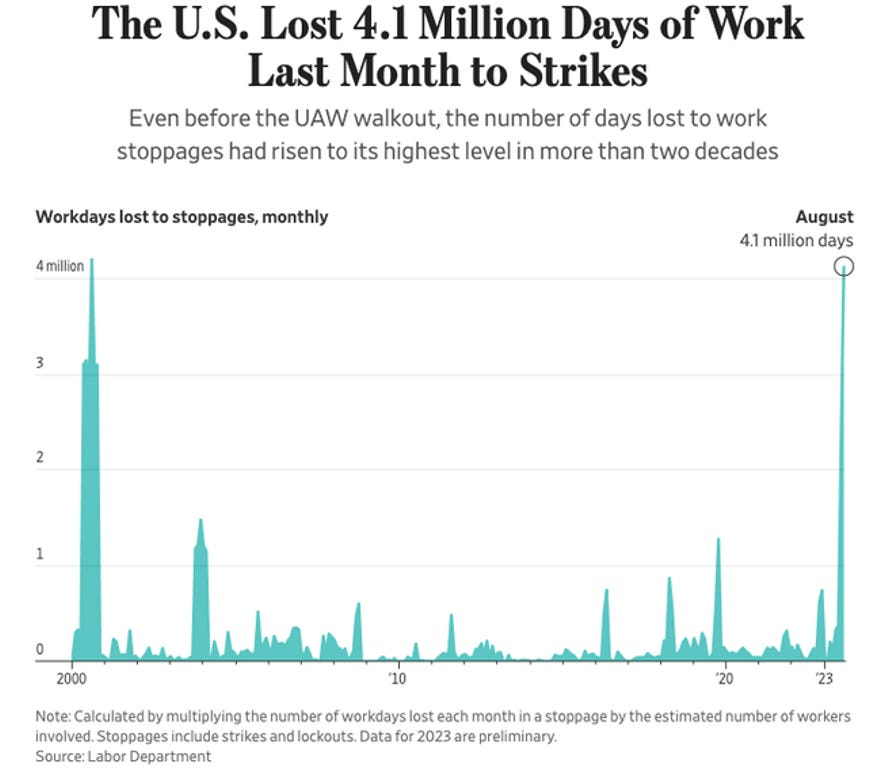

…while labor market dynamics suggest wage growth may entrench at higher levels…

As bargaining power shifts from capital to labor, strikes are on the rise

More so, engineering companies catering to IRA mega projects are already struggling for talent, and the demand surge has only just begun

…however, there are also some reasons for optimism

Following decades of low utilisation, there may be some headroom to expand industrial production

Further, Multi-Family oversupply is likely to keep a lid on rents for a while (though most Americans own and don’t rent…)

Ok great, growth ahead, no signs of concern?

No doubt, as always, there are also worrying signs with regards to economic growth, in particular around consumer spending. I perceive that as a possible soft patch that still echoes the slowdown of the goods economy, while the broad economic parameters remain robust

However, I may be wrong with this view, so what do I to look for to see the thesis invalidated? It’s simple - should the economy deteriorate from here despite the fiscal bazooka and indeed go into recession, we would see it first in initial jobless claims

Claims are released weekly and based on actual data rather than surveys, which makes them the highest quality labor market indicator2

Looking at the chart below, there is just no sign of any deterioration or negative trend. WARN notices and payroll taxes can give some guide as to where claims are heading, no sign of any worsening there either

Aside of the labor market, fiscal and bank flows are key too look for invalidation

For fiscal flows, the looming government shutdown and how it will be resolved is of importance. Spending cuts would obviously diminish the power of fiscal spending. I feel the shutdown risk is currently ignored by markets, probably because the debt ceiling in May was a non-event. Meanwhile, the odds of a shutdown at betting platform Kalshi are rising:

For bank flows, I would look to the weekly H.8 statement to see if there is any change in trend

Conclusion:

The size of the current and continued US deficit is unprecedented outside war or crisis

The full effect of several large reindustrialization programs has by far not unfolded yet

In a historic anomaly, bank flows have turned up and join fiscal flows in providing money to the economy

The US consumer still has plenty of excess savings and is now spending out of income

The US goods economy appears to have inflected upwards

The Fed’s actions so far have not done much. In fact, households and corporates are positively geared to higher rates

Inflation resurgence is a big risk. Diesel prices and strike days are concerning. Capacity utilisation may provide some headroom

= Significantly higher nominal, and initially likely higher US real GDP growth lie ahead. Inflation likely stays elevated, but may turn properly problematic only at some point down the line

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong, may change my mind at any time. This is not investment advice, please do your own due diligence

What does a higher growth world mean for asset allocation?

As laid out, it seems plausible to see high nominal and real growth first, later followed by higher nominal growth only, a.k.a. stagflation. Implications are different for each regime:

In a world of high nominal growth and high bond yields, history tells us value, small caps, commodities and real estate should do well

Using a logical filter instead of history, some nuances apply. Energy, metals, some banks & tech, industrials, small caps & dividend stocks stand out. Real Estate is the odd one out, with sky-high valuations due to the preceding 0%-interest era

The outcome of this historical and logical analysis ties in with the conclusions laid out before in “The Trillion Dollar Question” and “The Three Blind Spots”. It could very broadly be summarised as long US Value, which could then be narrowed down further e.g. to companies with high exposure to the IRA, IIJA, CHIPS etc.

However, one sector really stands out with green plusses across the board - Metals & Mining. Again, it is simple:

The re-industrialization of the United States will need millions or even billions of tons of materials, from steel to copper, from iron ore to coking coal, from lithium to nickel

After two decades of secular stagnation, material suppliers will be confronted with a demand avalanche, while no one has built or wants to build new supply in the real world, and no one owns these stocks in the financial world - there is one steel company in the S&P 500 (!)

More so, ESG considerations will continue to keep a lid on supply, while the premium for responsibly sourced supply likely increases. The IRA has a 10% bumper clause if input goods are sourced domestically

For the past year, this sector has been kept in check by the Covid-19 inventory whiplash across the goods economy. This is probably coming to an end (see above), while stimulus spending and domestic mega projects are now just getting started

Some more important considerations:

Not only metals & mining, many of the other likely favored sectors are cyclical and thus prone to volatile swings

I may be wrong with the thesis laid out today, or its timing sequence may occur differently

The current period has a high risk of market weakness, as liquidity is poor due to significant tax payments due in September, and this year also October (see here), while some headline risks appear underappreciated (cf government shutdown)

Having gone almost entirely into cash now, I therefore look to invest in this thesis with a margin of safety, which a sell-off over the coming weeks or months could provide

Should it not occur, I would rather wait longer or miss the trade

A final thought - does the end of Secular Stagnation also mean the end of extreme political polarisation? In some positive news, the Partisan Conflict Index drops to lowest level since the GFC (excl. Covid)

And if true, what are the implications for Europe? There, a different fiscal philosophy still dominates and where partisan conflict is on the rise again, as with the AfD in Germany or the Front National in France? Italy has already turned up the deficit-spending engine…

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

Sure, it may be financed by private sector savings unless banks or foreign demand steps in. But these savings may have otherwise likely been left dormant (see QE-period, unwillingness of private sector to invest). Further, the savings return to the private sector as spending, but in addition a private sector financial asset is created (T-Bills/bonds etc.) that may serve as collateral, or be swapped for other financial assets. As mentioned, I think - though I may be wrong - that we are not close to the point where public sector spending crowds out private sector investment. It was anaemic in the first place, likely leaving plenty of space for the public sector to stimulate

Claims data can also be distorted, e.g. by fraudulent submissions or temporary unemployment due to strikes etc, so it pays to always check the details

Well done as usual. I appreciate the detail that you lay out. The excess liquidity in the system is not discussed anywhere, but here. Clearly this has caused the recession to be postponed, not cancelled!

Really enjoying your work Florian!

And I promise its not just because I tend to agree with you ;)