Is MMT the answer?

A brief critique on a controversial theory

Having spent the past week on ski vacation in Austria, I came away with one thought. While we stayed at a higher-elevation resort with plenty of snow, the resorts closer to Munich where I learned skiing growing up had one thing in common - they were all green, at a time that should be the depth of the winter. Some used to have FIS race tracks and have now been shut entirely for several years in a row. In other words - Climate change is real and it is here. We can debate whether it is man-made or not until we are blue in the face, but it is bound to heavily impact our lives, increasingly so

Moving on to markets and the economy, in recent posts I suggested three views that at the time were unpopular and out-of-consensus, but now increasingly seem to be embraced by markets

First, in “Is the Honey Moon Over?” I put forward that inflation would likely return soon, as the tremendous easing of financial conditions by the Fed accelerates the US economy into the Spring, with a particular risk that January inflation would be “hot”

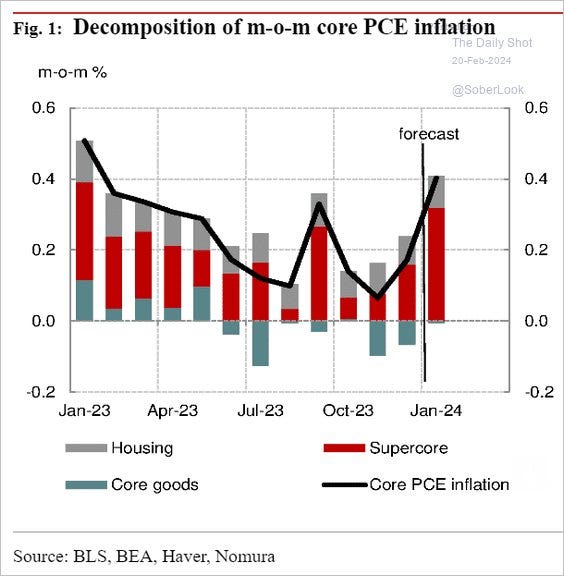

This has been confirmed, both the January CPI and PPI print were much hotter than expected, and are bound to push the Fed’s favorite inflation metric Core PCE back to uncomfortable highs, as shown in Nomura’s chart below, with “Supercore” in particular concerning

Second, in “Hawks and Supply” I opined that the substantial step up in US Treasury coupon issuance within the Treasury’s January 31st Quarterly Refunding Announcement would weigh on long-term rates, and I had sold the Treasury bond component of my long-term book in accordance. While most commentators described the QRA as “Non-Event”, the 30-year yield moved up 25bps since, pretty much in a straight line

Finally, in “Labor Day” following the release of the latest Non-Farm Payroll data I expressed the view that equity markets would likely top either in the last week of January or the first week of February. While tops are incredibly hard to predict as the tipping point of Fear-of-Missing-Out is not a rational process, it looks like the S&P 500 peaked on February 12th (i.e. I was a week early). I could obviously still be early or simply wrong with this view, but the market appears to be in distribution since

Either way, the stock market rally since the October lows has been tremendous, as generous US fiscal policy coupled with a dovish Fed provided fuel that seemed inexplicable by traditional economics. This has put the spotlight on a controversial economic theory that observers including former ECB-President Mario Draghi increasingly turn to for explanations - Modern Monetary Theory (“MMT”). On the fringes of economic science for the best part of the past two decades, its various axioms appear to better explain - at least to some degree - the mechanisms at work in “fiscal dominance” i.e. a state of the economy defined by exceptionally high government spending

Today’s post aims reviews some core tenets of MMT through a common sense lens, to hopefully discern what has merit from what may stand on a shakier foundation. As always, the post closes with my outlook on current markets

MMT - What my common sense agrees with

1. Interest rate hikes increase inflation

MMT view: If the Fed raises interest rates, it creates inflation rather than fighting it

Common sense view:

The calculation is rather simple: If US government debt/GDP hovers at ~130%, an interest rate increase from 1% to 5% represents interest payments worth ~5%/GDP from the government to the private sector. This is a huge subsidy to private accounts, currently to the tune of $1 Trillion annualised (!)

Now, the bills and coupons, and indirectly cash bank and money market fund accounts that receive these interest payments are not evenly distributed. Large corporates and affluent citizens typically have a lot of cash and little debt, small businesses and lower-income groups have little cash and more debt

Summary: This tenet has merit. However, it may be somewhat oversimplifying as some economic actors are still certain to suffer from higher rates, while the interest rate recipients may end up saving most of their additional income rather than spending it. So rather than being straight-forward inflationary, rate hikes may divide the economy more deeply into winners and losers

2. US Treasury bills and coupons are financial wealth

MMT view: US Treasury bills and coupons are cash like and/or create private sector financial wealth

Common sense view:

A simple thought experiment. I have $100k cash in my bank account at, say 2% interest. Next, I use the $100k to buy the equivalent amount of T-Bills to get 5% interest. I perceive my account just as cash-like as before, as T-Bills have no risk of principle loss. But someone else now has my $100k cash, either the government, which will spend it into the economy, or another economic actor. So yes, in my view it is fair to regard T-Bills as cash-like, and the more of them are issued, the more liquidity for the economy and financial markets increases (in the example, I now have $100k T-Bills and someone else has my $100k cash, so the amount of cash-like means in the economy has grown)

This thought experiment changes if I use the $100k cash to buy 30-year Treasury coupons. Anyone who has ever traded these knows that they swing wildly in value even on small interest rate changes, due to their long duration. If I owned $100k of 30-year, I would not perceive them as cash. In fact, if inflation was high and I did not trust the government to end it, I’d look to get rid of it as quickly as possible. In my view, yes, long-term Treasury paper is financial wealth, but in inflationary times an undesirable one to own

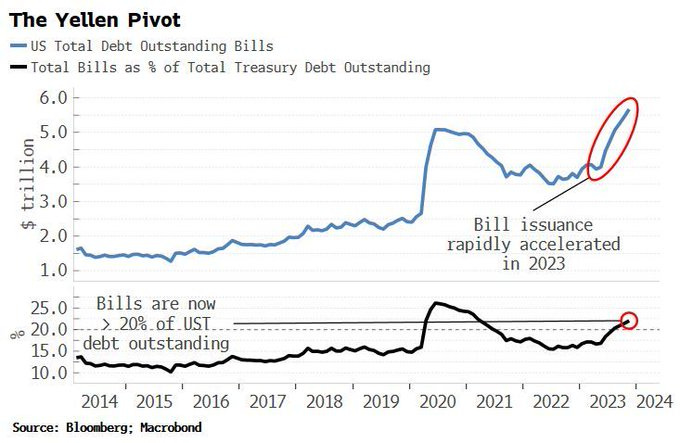

Summary: Again, this tenet has merit. It is fair to perceive T-Bills as cash, and the more of them are issued, the more liquidity for the economy and markets. Long-duration paper on the other hand is not cash-like, it may be incremental financial wealth, but of a potentially toxic nature

3. In fiscal dominance, the Treasury is more important than the Fed

MMT view: Focus on what the Treasury does, the Fed is either misunderstood (higher rates=more inflation) or powerless

Common sense view:

Below chart is a great illustration why I think this view has merit. Bank loan growth is driven by the level of interest rates and has stalled recently. Yet the economy has grown at a brisk pace, as the federal deficit far eclipsed the slowdown in credit

Derived from this is a view that I have much sympathy with, that fiscal and bank flows in combination to some degree correlate with asset prices. In other words, forecasting the deficit and bank flows provides some indication as to the path ahead e.g. for the S&P 500, as these flows need to find a home

Summary: Fully agreed, in fiscal dominance the Treasury is the “new Fed”. For the current quarter, Janet Yellen has decided to issue a lot of coupons, while bill issuance will actually be negative. This will likely weigh on markets. But the levers are there to reverse this in the future. They will be used, eventually likely aggressively (= prioritise bills > coupons to stimulate markets, e.g. closer to the election)

MMT - What my common sense disagrees with

4. Interest rates should be at 0%

MMT view: Interest rates should be set at zero. Instead, the economy should be kept from overheating by other means, e.g. taxes

Common sense view:

This may (or may not) work in theory, practically I do not see merit in this assumption. If the Fed set rates to zero tomorrow, a speculative frenzy would ensue as everyone and their mother would take out loans to buy assets. Animal spirits work instantaneously, any efforts to reign them in take a long time (e.g. raising taxes)

Summary: This makes little sense to me. While I agree that further rate hikes at high government debt/GDP may be stimulative to parts of the economy, the more obvious tool to prevent overheating would likely be Quantitative Tightening, which the Fed has shied away from in a meaningful way so far

5. Taxes should be used to prevent the economy from overheating

MMT view: Use government spending to stimulate the economy, and taxes to slow it

Common sense view:

This may work well on paper, but in reality the US political system has evolved to a state where tax increases are impossible. If congressmen raise taxes on the poor, they lose their election. If they raise taxes on the rich, they lose their donations and with it their ability to hold the seat. This leaves “stealth taxes” as the only viable path - and guess what is the most obvious “stealth tax” of all? Inflation

It is needless to say that inflation disproportionally affects poor people, which may also explain why so many Americans are currently unhappy with the state of affairs, yet no one seems to be able to properly explain why

Summary: Raising taxes works in theory, but especially in the US has very low probability of working in practise

6. Fiscal Dominance means Equities will “Crash Up”

MMT view: The financial wealth created by additional bills and coupons will lead to households indiscriminately piling into assets, sharply driving up their price (“crash up”)

Common sense view:

I perceive the economy and markets as similar to closed biological systems ever-oscillating around a balanced state, with no free lunches around. As such, if the government pumps trillions of bills and coupons into the economy, I find it unlikely that the only side effect would be higher asset prices. Much more likely in my view would be that inflation goes up, and with it long-term interest rates. That drives up the discount rate for all assets, which would level out the positive financial wealth effect from the larger supply of bills and coupons

I would also note that the recent run up in US equities was largely driven by the Fed indicating to cut interest rates, while the economy remained strong and inflation low for an intermediary period (i.e. the discount rate declined). Further, looking at some Emerging Markets examples (eg Brazil post 2016), one notices rapid stock market gains as both the deficit and inflation decline, whereas the Brazilian market was very weak in the period before of both high inflation and deficits

However, one way to “hotwire” the balancing effect of higher long-term rate is to suppress 10-30 years yields via yield-curve-control or other means. This would indeed create the “crash-up” mechanic, but at the cost of even higher inflation, as the slowing effect higher long-term rates have on the economy would be neutered

More generally, any crash-up in asset prices not rooted in fundamental reasons such as fading inflation or higher productivity is extremely negative for society (see Argentina or Turkey) and a pretty undesirable outcome overall. It could still happen of course, the political temptation will certainly be there

Summary: A “crash up” in asset prices likely requires governmental control of long-term rates. It is a possibility, but for now the US Treasury and Fed have not taken that step, and there is no sign that they are close to doing so

Conclusion:

MMT is a controversial economic theory, however it has contributed important view points that have merit. These included unexpected stimulative effects of rate hikes in fiscally dominant regimes, the relevance of bills and coupons as financial wealth or even cash, as well as the focus on the Treasury as dominant actor, with the Fed in a secondary role

The common sense test appears to show weaknesses in the demand for 0% interest rates and taxation as means to slow overheating, which seem in conflict with practicality and animal spirits. Finally, the recent “crash up” of US equities seemed to be driven by the expectation of lower rates and inflation amidst a still booming economy, rather than an oversupply of government debt. More broadly, an inflationary “crash-up” of asset prices seems more plausible if/once the government surpresses long-term yields, which is not the case (yet!)

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

This is my current stance across short-term and long-term allocations:

Short-term book (Active Trading, Long & Short, Changes Frequently):

I notice three dynamics with regards to current markets:

Teenagers are trading semiconductor stocks, just like in the ‘20/’21 SPAC frenzy or in fact the New Economy bubble (see WSJ article here “These Teenagers Know More About Investing Than You Do”)

As per prime broking data, hedge funds in the past week bought the most semiconductor exposure in over a year

Hedge fund exposure in Nvidia is described as a “10 out of 10” into earnings, with everyone certain of a dramatic beat (what if the outlook misses?)

With semiconductors having lead the rally year-to-date, this tells me that the boat is now more than full and plenty of room to disappoint panicked late-comers. At the same time, I notice the overwhelmingly positive feedback on Google’s OpenAI competitor Gemini, with the company perhaps prematurely written off as AI-loser. This lead me to set up the Long Google/Short Semis pair yesterday at the open. In addition, I still have the S&P puts looking for market weakness in the weeks ahead, as well as newly established GBP/USD short as the BOE seems ready to cut while the Fed drifts in the other direction. I’ve closed the small cap and regional bank relative trades as my sense is market weakness may originate from the very crowded momentum trade heavy on quality and tech, but still find them attractive and look to set them up again another time. I have also added a Natural Gas long, which shares the same bottom forming characteristics China showed earlier this year (I am still long China in the long term book)

In summary:

Long Google/Short Semis

S&P 500 puts

Short GBP/USD

Long Natural Gas (small- very volatile!)

Long-term book (Asset Allocation for Medium & Long Term):

I find US equities and bonds across the board expensive, so have sold the S&P 500 and AI 2nd Leg basket yesterday. While I continue to like European, Oil and Chinese equities, I am waiting for better opportunities to deploy capital into US equities (and bonds). These may arise in late Spring/early summer as presidential election years typically see a strong second half (for obvious reasons)

86% T-Bills

14% Equities (5% DAX, 5% XLE, 4% China Equities)

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

Florian, thanks for a balanced view on MMT. I have mostly found that the usual analysis is so slanted that it is clear from the outset the writer didn't like it and busily built a straw man to burn.

I have written on the topic as well and agree with your points. Here are some additional thoughts:

1. MMT generally describes how the economy and financial system work under two conditions:

(a) when the currency isn't backed by either a metal standard or pegged to another currency. In other words, there is no financing constraint; and (b) when the central bank isn't independent.

2. MMT also seems to assume that there are some elements of capital controls. If investors lose confidence in the fiscal authority, capital flight can ensue which does act as a constraint on the government. Hyman Minsky suggested that even under a fiat system, fiscal austerity is needed on occasion to maintain faith in the bonds/bills issued by the fiscal authority.

3. Raising interest rates leads to higher inflation if and only if the debt of the government is large. If it is small, that shouldn't be the case. Why? Because the interest earned on government borrowing won't be enough to matter.

4. Related to #1, in the absence of a global gold standard, the new standard is USD/Treasuries. What has created faith in that system is (a) independent central banks and (b) confidence in a stated inflation target. It is unclear what happens if these 2 conditions are violated.

Anyway, thanks for your work.

Really interesting piece.