Shorts Squeezed, What's Next?

Three scenarios, and what I deem the most likely

In my last post “The Treasury Blinked” I described how the Treasury’s decision within its Quarterly Refunding Announcement (“QRA”) to issue less long-term debt than expected would lead to a short squeeze in equities, for which I bought Small Caps and some Unprofitable Tech. This is exactly what happened, with those segments indeed the fastest horse with a 5% and 8%1 advance in only two days

As equities repriced aggressively, one wonders whether this just the market punishing hedge funds who were once again offside in their very crowded bearish positioning, or indeed a pivotal moment that now alters the trajectory of markets and the economy

For this we need to investigate three critical questions, from which in turn I derive three possible scenarios ahead. I find it too early to tell where the dice will likely fall, however I will share my inclination and what I believe one should look for to judge which path eventually shapes out

As always, the post closes with my current outlook on markets

To judge the lasting impact from the Treasury’s decision to prioritise short-term bills over long-term coupons2, and thus the path ahead for the economy and markets, we need to find answers to three critical questions. These are all intertwined, so presented in no particular order:

Question 1: What trajectory is the US economy currently on?

Pre-QRA: Nominal growth is slowing down, likely heavily exacerbated by higher long-term Treasury yields

Now:

Likely still the same near term - recent data affirms the notion of an economic slowdown, with GDP estimates down to ~1% growth for 4Q and various other metrics below expectations (e.g. ISM Manufacturing at 46.7)

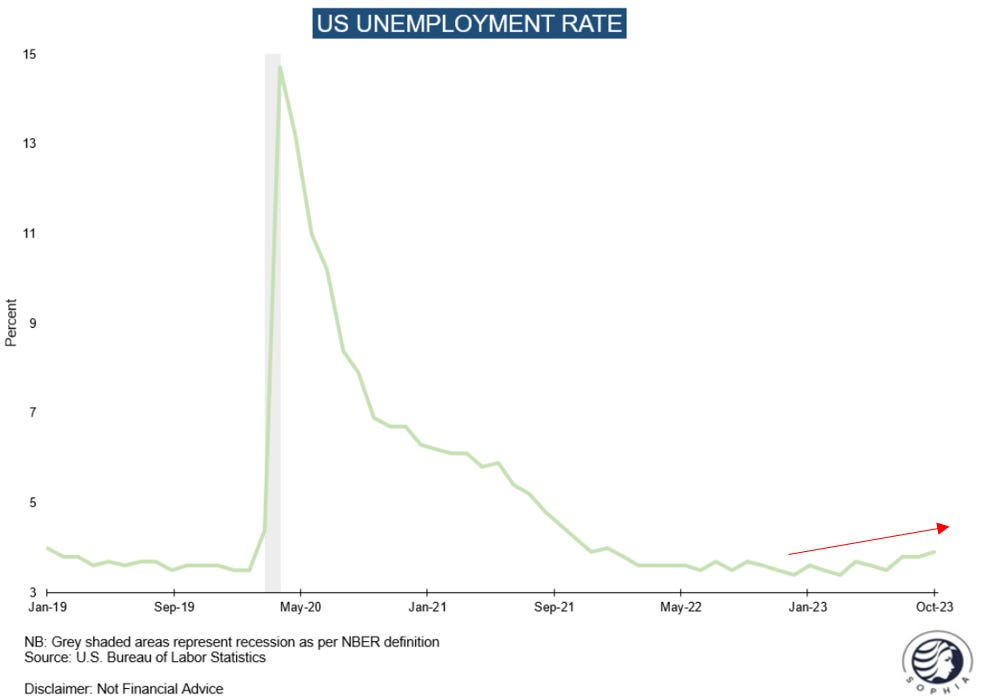

In particular past Friday’s NFP labor market report was soft, with the unemployment rate increasing to a 1.5 year high of 3.9%

Answer: The US economy will likely continue to slow down, and the labor market trend is concerning

Question 2: How much will this trajectory be impacted by the current easing of financial conditions?

Pre-QRA: Financial conditions are very tight, with real rates significantly above what history implies (see “On Real Rates”)

Now:

Higher bills issuance means more liquidity for the US economy, as these are near-cash instruments that can provide low-risk collateral and can be levered. Higher asset prices in the wake of the QRA decision could also help support consumer and corporate confidence, should they last

Importantly however, despite al the noise, the all-important long-term bond yields have not moved much in the grand scheme of things. By dropping from 5.1% to 4.8%, the 30-year Treasury bond yield simply returned to its level from ~4 weeks ago

Answer: The QRA-decision likely prevented the US markets from going over a cliff in the short term. However, the stimulative effect to the real economy remains unclear. It may be limited

Question 3: What is the demand for long-term US treasuries?

Pre-QRA: No real demand for US long-term debt, except for trading positions. With foreigners, banks and the Fed, three important buyer groups are out of the market

Now:

On the one hand, the Treasury has shown its hand and adjusted its plans in favor of bills as 10/30yr yields hit 5%+. The market could perceive this as an implicit line in the sand and expect the same to be repeated, should yields rise again. Thus, the Treasury could be seen as having implemented an implicit Yield Curve Control (“YCC”) at ~5%

On the other hand, this decision comes at a cost. Prioritising bills over coupons is an Emerging Markets move that historically often lead to higher inflation and with it higher long-term yields. Investors may anticipate that and not want to own duration until Yield Curve Control is explicitly established

Answer: Unclear. The reaction function for private sector US Treasury bond investors is not publicly known. We will need to derive it from market price action in the coming days and weeks

As long as especially the answer to the last question remains ambiguous, I see the following three scenarios as possible:

Scenario 1: First Cut Equivalent

Key summary: Long-term yields are still too high for the economy, but still too low for all the issuance to come

Yes, the Treasury reduced coupon supply significantly vs expectations, but it is still a historically high amount outside of periods when the Fed acquired Treasuries (“QE”)3

In this scenario, the easing of financial conditions is too little to change the economy in its path - in a fiscal dominance/primacy world, the Treasury’s action is akin to the Fed’s first rate cut in a downturn, where several more accommodating steps are usually needed to turn the economy around

Implication for the economy: Trajectory still down

Implication for risk assets: Downside ahead after the squeeze

Scenario 2: Soft Yield Curve Control (“YCC”)

Key summary: The Treasury has managed to established soft yield curve control

The market prices in the signalling effect of Treasury having blinked. Thus, long-end yields find buyers below their natural level. They are effectively suppressed

This stimulates the economy and leads to high nominal growth

Implication for the economy: Downtrend turns up. Inflation likely follows

Implication for risk assets: Upside as nominal growth increases, but long-term yields stay comparatively low given soft YCC

Scenario 3: Buying Time

Key summary: The long end stabilises for now, but drifts higher later as the easing of financial conditions turns out to be inflationary

The current financial conditions easing leads to temporarily improved economic activity. However, this come at the price of higher inflation down the road (e.g. via higher oil prices etc.)

Long-term yields find some demand now. This wanes again as inflation ticks up

Implication for the economy: Downtrend temporarily stalls or turns around. Inflation likely follows

Implication for risk assets: Window of stability followed by downside as inflation brings up long-term rates again in absence of YCC

So what will it most likely be? If I apply some common sense judgement to the above scenarios, then I steer to the first one. Why?

If the economy slowed with 5.1% 30-year rates, it will likely also slow with 4.8% 30-year rates

The US deficit is still forecast to be astronomical for years. With no appetite for deficit reduction by whatever means from either political party, higher long-term inflation appears the most logical outcome to solve the debt issue. Why buy long-term nominal bonds then for anything but a trade?

Yes, markets may have priced in a worse scenario recently. But the huge short squeeze has made positioning more even and now we’re forward looking again

Finally, I believe that broadly the economy moves like a tanker. It takes huge effort to turn it, but once that is done, the turn is hard to stop. I do not believe the recent easing in financial conditions is enough to turn the tanker

The US unemployment rate is trending higher now. In the past, whenever it went a bit, it eventually went up a lot

NB: We have to keep in mind though that this datapoint may be somewhat skewed by the UAW strike, so I would not put all the weight on it

Now, what I see as common sense and what the market ends up doing may very well differ. I may be missing many dynamics given the reflexively interdependent variables that shape the economy, and at this juncture, right after the QRA-event, are particularly hard to read. So my current view is held loosely until more information comes through

To firm up in whatever direction, I will look for what the market will be telling us. We likely find an answer there, before economic data presents a convincing case (see “On Listening to the Market”). In particular, I will be looking for the following:

For long-term bond demand:

How does the long end react to incoming data, especially if it is weak? If yields are up or flat on soft releases, it indicates that supply is still too large (and vice versa)

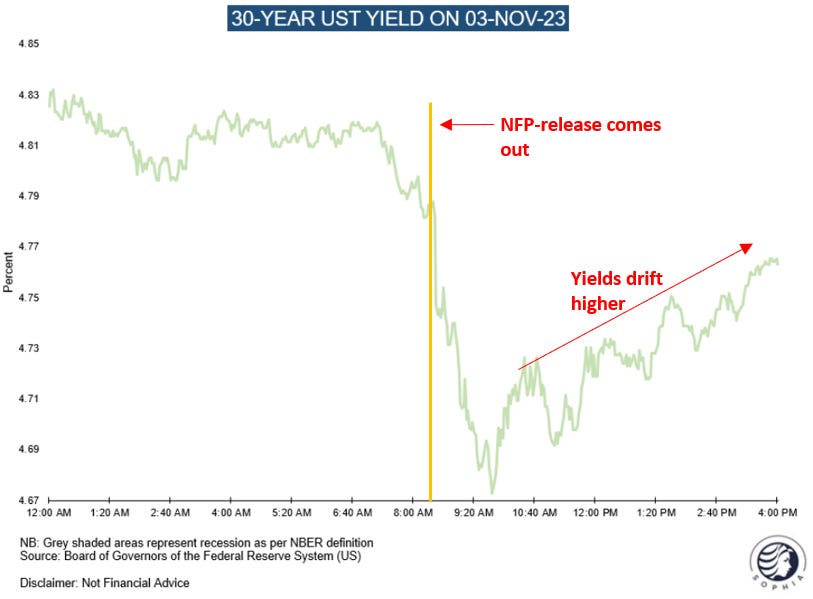

Friday’s NFP release is a good example - the data was, as discussed, soft. In response, 30-year yields initially dropped, but recovered by the afternoon

For the trajectory of the economy:

Will equities return to the trends they have previously broken? I’ve shown the below chart of the S&P 500 equalweight before. We will need to see whether it manages to establish a new uptrend

Conclusion:

The Treasury’s decision to reduce its long-term debt issuance relative to expectations triggered an explosive rally in risk assets

We now need to wait for the dust to settle, to judge whether the impact is enough to change the trajectory of the economy and markets

I think it is unlikely for variety of common sense reasons. But these could be misleading, so until I can see more evidence in market data this view remains loosely held

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

In my last post, I spelled out why I would buy US Small Caps and some Unprofitable Tech in expectation of a short squeeze due to loosened financial conditions. This short squeeze has now happened in a very aggressive manner in a very short amount of time. This tells me that price action is likely positioning driven and real buying still scarce, so I’ve exited these positions again on Friday afternoon for a decent gain

In the very short term, I am leaning bearish equities and have shorted them at the Sunday futures open (see here). I believe positioning has cleared after the squeeze, volatility possibly troughs here, long-term yields should drift higher in the short run as the auction calendar is heavy again this week, and most wrong-footed bond shorts probably covered by Friday. I’ve chosen outright index shorts instead of puts as I can also see some sideways chop that may just kill options premium. My stop loss is tight,, as there are also seasonal flows that may work the other way, and still some residual drift from the big up-move

This is a trading view that I may change or even flip around momentarily, and is guided by what is laid out in today’s post. I may also end up keeping it for longer, should yields continue to rise past Wednesday’s $48bn 10-year auction, so there is some optionality around it

As discussed, for more than this tactical view at least I personally would need to listen to the market somewhat longer. I hope we get more answers soon as to what scenarios from above are the most likely

Either way, TIPS likely remain the most attractive asset class right now in terms of risk reward. Sure, long-end real rates may widen again if nominals do so, too. But are they lower a year from now? I think it is plausible, if you do not mind mark-to-market risk (I do, so I still haven’t bought these yet…)

Gold has seen a strong bid on the Israel/Hamas war. But now both Hezbollah and Iran seem to stand down, and in the short run real rates may not have much further to fall. I could see some profit taking there. Looking further ahead, most long-term scenarios seem to favor upside, though the competition with yield-paying TIPS is tough

Unprofitable Tech’s cover bid may have trouble to translate into further gains unless the 10/30yr yield comes down further. I think the odds are that the short squeeze there is largely done, I may be wrong though. More lasting upside will probably need to see the long-end come down. For Biotech, the logic may differ given the exciting development around CRISPR technologies

Finally, I find it unlikely that the Treasury will be able to issue more coupons (long-term bonds) than currently planned at any point in the next 1-2 years

If the markets throws a total tantrum at $338bn coupon supply per quarter, how would it ever absorb significantly more, without the help of the Fed, unless money supply expanded massively in the interim?

With little willingness to address the deficit via taxes or cuts, I think we are very likely set for much higher bill issuance for quite some time, and with it eventually, likely, structurally higher inflation

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

Using Morgan Stanley Unprofitable Tech Index as proxy (MSXXUPT)

Also keep in mind, the previous issuance peaks saw mostly little bill supply

Absolutely insane timing on calling the short squeeze. Well deserved profits, i hope.

Thanks for sharing your analysis time and time again.

One of the best guys out there for sure. Florian is perhaps a big shot in the finance world, but still humble enough to listen an idea from even a silly retail (like me lol). I see his interactions on twitter, always open to dicussions and learn/respond to very differing viewpoints.