On Listening to the Market

What are its guts telling us about the economy?

Regular readers will be familiar with my framework as detailed in “On Reflexivity” (my most important post, please read it if you haven’t yet). It describes how the real economy and financial markets are connected via countless interdependent feedback channels. These create outcomes often entirely contrarian to everyone’s assumptions, with the prime example high recession expectations that can make a recession less likely

Positioning is key to understand these dynamics, as it is the “hard currency” of market participants’ sentiment and views. Applied to today, as I’ve spelled out in recent posts, I see the crowd bullish equities, bullish long-term Treasury bonds and bearish safe havens such as gold or the Swiss Franc - all of which tells me odds are decent the opposite occurs

Aside of positioning, the other important input to understand where the puck is going is price data itself, following Druckenmiller’s adage that the best economist is “the guts of the market”. For this, we are looking at relationships between various markets segments over time. In particular, we look for trends, and whether they appear to be broken. Today’s post provides a review of said guts

As always, today’s post concludes with my current view on markets. I remain all-cash until the Treasury tantrum settles. Until then, I am looking for equity downside via puts, and hope to eventually go long with the margin of safety a larger sell-off could provide

So for today, our aim is to create a holistic, market-based view of the US Economy. For this we depict various market segments over time, some of them in ratios against each other. Again, we are looking for trend continuation or cessation for meaningful signals1

Let’s dive in:

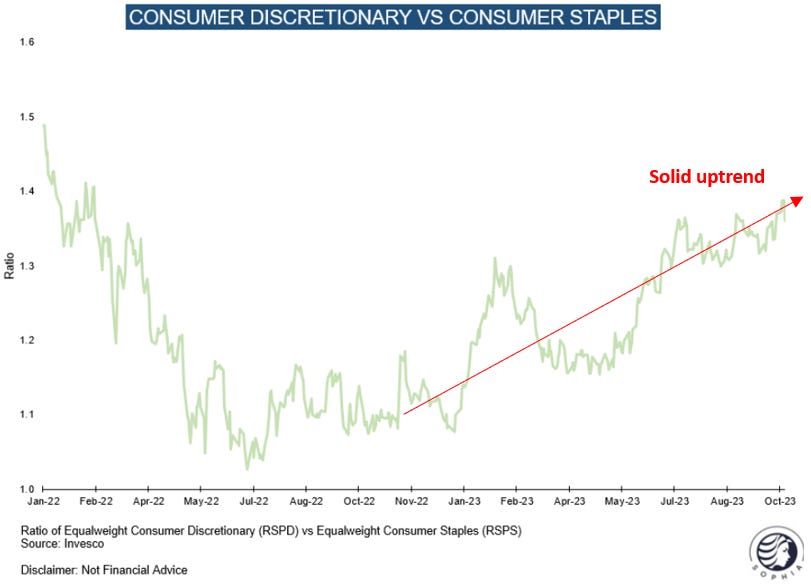

The Health of the US Consumer - Consumer Discretionary vs Consumer Staples

This ratio pits companies that cater to optional spending against companies that provide daily needs, such as food, beverages or toiletries

An uptrend would indicate that earnings expectations for discretionary companies rise faster than for staples, typically a sign of an expanding economy

Diagnosis: Uptrend in place

The Health of the US Consumer (pt. 2) - Consumer Discretionary vs Defensives

An alternative ratio that incorporates a broader range of defensive spend such as healthcare or utilities

Over the past months, many Staples companies sold off heavily as the success of wonder-weightloss drug GLP-1 impacted their business outlook (e.g. Coca-Cola, McDonald’s etc.). So the above picture may be skewed. To get a more unbiased view, I’ve added the two other traditionally defensive sectors Healthcare and Utilities in equal parts to Staples in the denominator

Diagnosis: Uptrend broken

The Health of Large Companies - S&P 500 Equal-Weight

To get an understanding of what the market could imply about the direction of the US economy, we should look at both large corporates and small caps. Each employ ~50% of Americans

Now, large corporates have traditionally been represented by the S&P 500. However, the “Magnificent 7” Tech stocks that drove most of the index return this year only employ ~2% of Americans. In my view, it is therefore better to look at trends in the equal-weighted version of said index

Diagnosis: Uptrend broken

The Health of Small Companies - Russell 2000

Small caps may only represent a minor share of US stock market capitalisation, but they employ half of Americans. Given their smaller size, they are also more sensitive to changes in economic conditions. We need to pay close attention to them

The Russell 2000 reflects how their business outlook is going. It is not a great picture. Keep in mind, if small caps are struggling, eventually it catches on to large caps, too (who is booking Google’s ads?)

Sure, this trend could also indicate a buying opportunity as small caps have fallen a lot. I am hard-pressed to look ahead though and not see the rising long-term yields as an issue for them

Diagnosis: Downtrend likely in place

Global Trends - US vs Europe

Let’s zoom out to a bigger picture in both time and geography. Plotting US capital markets against the rest of the world (in equities represented mainly by Europe) could give clues as to the relative strength of the US economy

With the tailwind of QE and ultra-low interest rates, US capital markets experienced an exceptional decade vis-a-vis their European counterparts

This trend appears to have ended, which is notable given the ubiquitous expectation of Europe’s imminent implosion. The biggest reason behind this is that European stocks are most value, i.e. low PE multiple, so less affected by rising rates

Diagnosis: Uptrend broken

The Everything Chart - Equities vs Bonds

We now come to the most important chart of all, that of US equities vs bonds (Wilshire 5000 = all US stocks vs US long-term Treasuries). It depicts the broad “risk on” or “risk off” context we find ourselves in, applicable both to markets and the real economy

In the current case, a rising trend essentially means that equity earnings grow faster than their multiple contracts due to a higher discount rate2, a bullish context

The ratio is still in a very clear uptrend, however there are increasing jitters at the end. That could indicate a topping formation - volatility typically rises towards the end of a trend

My view is that we could indeed be in the topping stages. The previous charts all tell us that the state of the US economy is now seen as less good than a few months ago. This would imply more risk to earnings than before, while yields are eventually less likely to go down further as they hurt the economy, which in theory means this trend should stall or revert

Diagnosis: Trend may be in late stages, particularly when other recent trend breaks are taken into account

Let’s summarise: What is the market telling us, via its millions of specialist and highly knowledgeable participants who form its prices every day?

The consumer is expected to show signs of weakness ahead, as the trend of discretionary companies outperforming defensives appears broken

Large corporates are expected to show some earnings weakness relative to expectations in the coming months as the S&P 500 equalweight uptrend appears broken

The same applies to small caps, which are in a pronounced downtrend

On an international level, the multi-decade US outperformance may have run its course

It appears that the outperformance of equities vs bonds could be in its late stages

So, several important trends have been broken, and some appear to be broken soon. What is behind all this? The answer, in my view, is simple

Since the release of the US Treasury’s Quarterly Refunding Statement on August 2nd, US long-term Treasury yields have marched higher, and in their last leg have done so in a disorderly way (I’ve covered this closely here, here and here)

The market is telling us that this rapid shift in the world’s most important and supposedly “risk free” asset is difficult for the US economy

In particular small caps, which employ 50% of Americans and are the most vulnerable to abrupt economic changes, do not like it at all

Again, just like the frog in boiling water, it is much less about the absolute extend of this shift, and much more so about the speed at which it happens

What does this mean for markets?

The following section is for professional investors only. It reflects my own views in a strictly personal capacity and is shared with other likeminded investors for the exchange of views and informational purposes only. Please see the disclaimer at the bottom for more details and always note, I may be entirely wrong and/or may change my mind at any time. This is not investment advice, please do your own due diligence

What does the above conclusion tell us? I think it is telling us that too much US Treasury supply is coming to markets too quickly for them to absorb it. I see the following cadence of events as possible, with Reflexivity once again at work between financial markets and the real economy:

As a first step, the issuance draws liquidity out of asset markets. What is important here: Yes, said liquidity returns to the economy as the government spends what it raises. If this occurs gradually (and within proportion), there is enough time for the cash to filter back through the economy to avoid distortions

A sudden rise however introduces asymmetry. How? Large asset owners buy treasuries. To do so, they wire cash to the Treasury. Next, the government spends the funds it raised, mainly by redistributing to lower income groups. These save some, but mostly spend the cash into the economy. With a time lag, this cash filters through and eventually shows up again at asset owners incl. institutions

Here’s what is crucial: It takes time for government spending to filter through the economy. But asset owners buying those Treasuries need to make a decision today, especially if they are low on cash. Do they accept the bond offer from the government, and sell something else? Or do they shun the bond offer, and wait for better terms? How is this solved? Via yields rising to a level that is eventually attractive vis-a-vis other assets, in this case mainly equities, whose allocation is historically high following 20 years of low real yields

With real yields at ~2.5%, we are at attractive levels. For example, if you buy a 5-year US Treasury TIPS bond, you get paid 2.5% + the inflation rate over that period. If we assume that is 3.5% p.a., we get to an all-in 6% risk-free (!) yield. Any other asset has to compete with that offering

The more supply, the higher yields have to go to clear the market. Asset owners will sell equities to lock in these attractive offers, and a reflexive wheel sets in motion:

Equities are sold. It is no coincidence that the ‘23 stock market high was just a few days before the 2nd August Treasury supply announcement.

In response, established trends are broken. Market participants observe this and lower their economic growth expectations. This makes equities less appealing vs bonds. As a consequence, more equities are sold

Equities decline further. That sets off a reflexive motion into the real economy. For example, companies will want to prop up their share price via cost cutting (read layoffs), or affluent Americans, whose consumption is correlated to their stock portfolio, spend less. We can already see that in the luxury industry, where sales have lagged due to lower stock-based compensation weighing on top-decile income growth

This self-reinforcing downward spiral goes on until a market clearing price is found. However, it is much more likely that the various government institutions won’t wait for that, as it might be quite high (in yield). I would expect the Fed to eventually change its policy and provide additional liquidity to markets. This could be via ending QT, opening a new repo-facility or some other creative measure that does not have to be labelled “QE”, but might achieve the same goals

The risk to said policy change is inflation, but let’s cross that bridge once/if we get there. Either way, until that moment this is not a great context to own risk assets.

Thus, my plan remains the same as spelled out in previous posts. I am in interest-paying cash since early September, and intend to buy puts, as I’ve done last week, on any equity rally until a significant low is in. In a reflexive way, such a low might both force a policy change that creates a tailwind for risk assets, and would provide me with a chance to go long risk with a margin of safety

To be clear, this plan may be wrong. The low may have already happened. I may see bullish positioning when it is in fact bearish (see post last week debating various sources). I may be subject to all sort of behavioral biases myself when creating this analysis. In a probabilistic economic world nothing is certain, these are just my best efforts to make sense of what I see

Thank you for reading my work, it makes my day. It is free, so if you find it useful, please share it!

DISCLAIMER:

The information contained in the material on this website article is for professional investors only and for educational purposes only. It reflects only the views of its author (Florian Kronawitter) in a strictly personal capacity and do not reflect the views of White Square Capital LLP and/or Sophia Group LLP. This website article is only for information purposes, and it is not intended to be, nor should it be construed or used as, investment, tax or legal advice, any recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or an offer to sell, or a solicitation of an offer to buy, an interest in any security, including an interest in any private fund or account or any other private fund or account advised by White Square Capital LLP, Sophia Group LLP or any of its affiliates. Nothing on this website article should be taken as a recommendation or endorsement of a particular investment, adviser or other service or product or to any material submitted by third parties or linked to from this website. Nor should anything on this website article be taken as an invitation or inducement to engage in investment activities. In addition, we do not offer any advice regarding the nature, potential value or suitability of any particular investment, security or investment strategy and the information provided is not tailored to any individual requirements.

The content of this website article does not constitute investment advice and you should not rely on any material on this website article to make (or refrain from making) any decision or take (or refrain from taking) any action.

The investments and services mentioned on this article website may not be suitable for you. If advice is required you should contact your own Independent Financial Adviser.

The information in this article website is intended to inform and educate readers and the wider community. No representation is made that any of the views and opinions expressed by the author will be achieved, in whole or in part. This information is as of the date indicated, is not complete and is subject to change. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified. The author is not responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the author assumes no obligation to update or otherwise revise such information. At the time of writing, the author, or a family member of the author, may hold a significant long or short financial interest in any of securities, issuers and/or sectors discussed. This should not be taken as a recommendation by the author to invest (or refrain from investing) in any securities, issuers and/or sectors, and the author may trade in and out of this position without notice.

It is important to keep in mind that the market is forward looking. Investors assess their outlook beyond next month’s data releases, with the price formed by someone changing their view on the margin

It could also mean that the discount rate declines faster than earnings estimates, which does not apply to the current context

I really appreciate the clarity and comprehensive approach of your analysis, thank you for sharing your view!

The Mag 7 employ roughly 6.6 million Americans? 😳